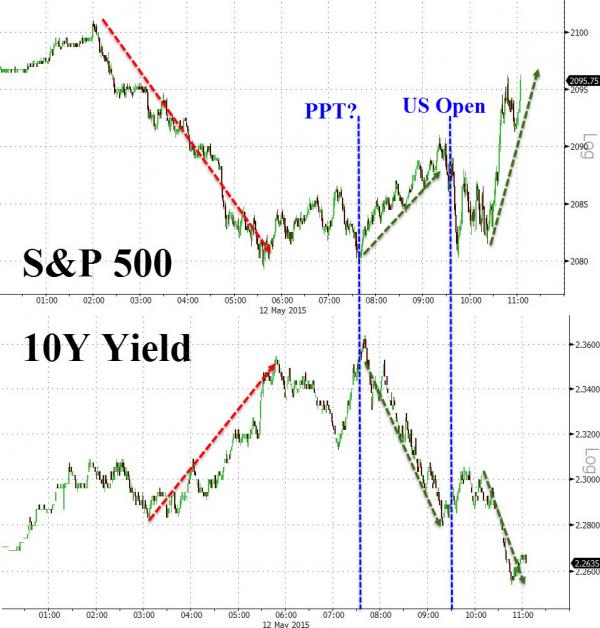

That didn’t take long did it? I of course am speaking of the second overnight and global meltdown of the credit markets …in the last four business days! Before getting into this topic which I believe will soon be seen in retrospect and by historians far into the future as “THE” trigger event. Just as we saw last Wed. …

The Clintons and Their Banker Friends – By Nomi Prins

[This piece has been adapted and updated by Nomi Prins from chapters 18 and 19 of her book All the Presidents’ Bankers: The Hidden Alliances that Drive American Power, just out in paperback (Nation Books).] The past, especially the political past, doesn’t just provide clues to the present. In the realm of the presidency and Wall Street, it provides an ongoing pathway …

Our Ayn Randian Dystopia: The Five-Step Process to Privatize Everything – Paul Buchheit

Law enforcement, education, health care, water management, government itself — all have been or are being privatized. People with money get the best of each service. At the heart of privatization is a disdain for government and a distrust of society, and a mindless individualism that leaves little room for cooperation. Adherents of privatization demand ‘freedom’ unless they need the …

More Nails in the Coffin of the Middle Class: 5 Things That Could Make Life Even Worse for Most Americans – Alex Henderson

If trickle-down economics were anything other than a cruel deception, the United States’ embattled working class would have many reasons to join Wall Street in singing “Happy Days Are Here Again.” Giant megabanks have been reporting huge profits for 2015’s first quarter, including $5.91 billion [3] at JPMorgan Chase (the largest bank in the country) and $5.8 billion at Wells Fargo. But trickle-down …

The Six Too Big To Fail Banks In The U.S. Have 278 TRILLION Dollars Of Exposure To Derivatives

The very same people that caused the last economic crisis have created a 278 TRILLION dollar derivatives time bomb that could go off at any moment. When this absolutely colossal bubble does implode, we are going to be faced with the worst economic crash in the history of the United States. During the last financial crisis, our politicians promised us that they …

There’s a Reason the Big Banks Aren’t Mad with Hillary

The Banks are hopping mad at Elizabeth Warren. So mad, they’re threatening to stop contributing money to the Democrats unless she stops being so … so … accurate in her criticisms. Translated, this means they realize she can’t be bought. Small wonder – Warren has been outspoken, plainspoken and passionate on where she stands on the economic issues of the day, which, …

How Privatization Degrades Our Daily Lives

The Project on Government Oversight found that in 33 of 35 cases the federal government spent more on private contractors than on public employees for the same services. The authors of the report summarized, “Our findings were shocking.” Yet our elected leaders persist in their belief that free-market capitalism works best. Here are a few fact-based examples that say otherwise. Health Care: …

Public Banking: Ayn Rand’s Worst Nightmare

A few weeks ago a Colorado grassroots group, Be the Change, of which I am a board member, sponsored an all -day conference on public banking. I know, it sounds like the equivalent of an all- day climate debate between aging Republican Senators, but the public banking concept may have some value, it might even surprise you. Indeed, it …

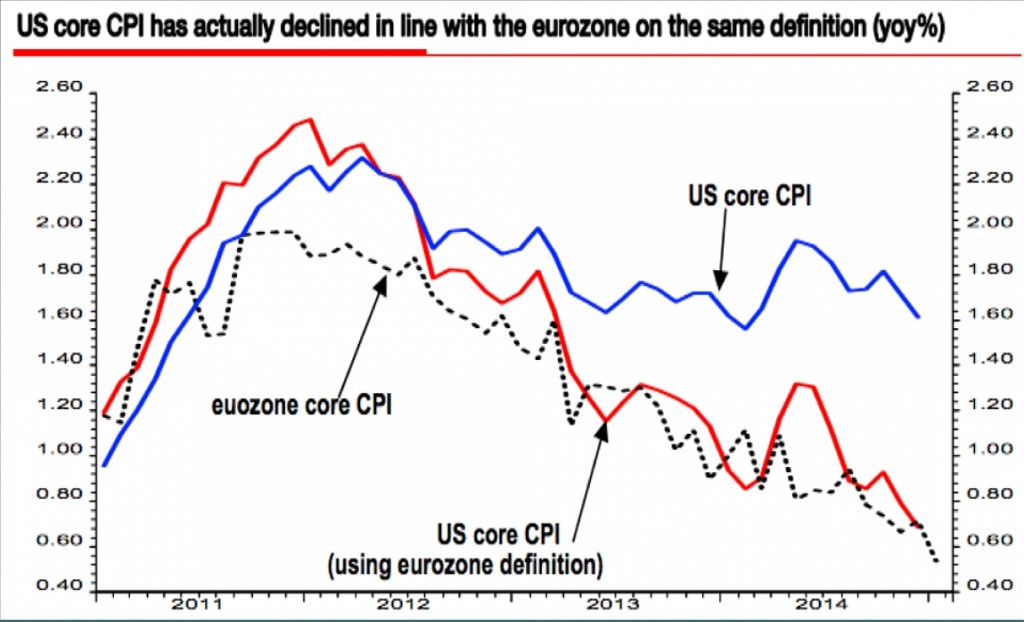

“Core Inflation In The US Would Be Just As Low As In The Eurozone If Measured On The Same Basis”

Anyone with a pulse knows that Europe is stuck in a downturn worse than the Great Depression. Most think that the U.S. has fared better … but that is debatable. Mega-bank Société Générale’s strategist Albert Edwards notes: “Core Inflation in the US would be just as low as in the eurozone if measured on the same basis, despite the US having enjoyed much …