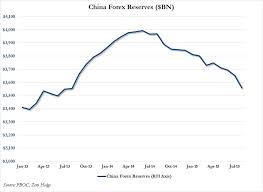

Shortly after the PBoC’s move to devalue the yuan, we noted with some alarm that it looked as though China may have drawn down its reserves by more than $100 billion in the space of just two weeks. That, we went on the point out, would represent a stunning increase over the previous pace of the country’s reserve draw down, which …

It’s Our Money with Ellen Brown – If Capitalism is so great, then why….. – 09.02.15

Capitalism is often touted as the most dynamic marketplace performer capable of lifting more boats faster than any other — but why then do we see its colossal failures as a stable and equitable driver of well-being for the vast majority of its practitioners? Ellen speaks with one of the most knowledgeable economic experts on economic systems, Dr. Richard Wolff, about how capitalism fails in part because of its anti-democratic underpinnings that rock many of those boats and swamp others while letting the captains of capital cruise on. We also talk about the emerging popularity of Quantitative Easing for the People and the importance of values-driven common cause for change.

It’s Our Money with Ellen Brown – The Centrality of Central Banks – 08.19.15

“No flow, no go.” That may be the simplest way to describe the critical role of central banks to the flow of credit and money into any monetary system. It was the lack of access to cash and bank liquidity that humbled Greece, Detroit and others. Ellen speaks with Dr. Timothy Canova, one of the foremost experts on our central bank, the Federal Reserve, about why their operation of our cash spigot determines who wins and who loses. Co-host Walt McRee speaks with Gwen Hallsmith about a newly published handbook focusing on new ways to invest in local economies and Matt Stannard reviews the Fed from a visionary point of view – what could be accomplished if the Fed worked for the public interest?

We Are All Greeks Now By Chris Hedges

The poor and the working class in the United States know what it is to be Greek. They know underemployment and unemployment. They know life without a pension. They know existence on a few dollars a day. They know gas and electricity being turned off because of unpaid bills. They know the crippling weight of debt. They know being sick …

Credit Markets have Melted Overnight. Derivatives are a $1 Quadrillion “Ticking Time Bomb” – Bill Holter

That didn’t take long did it? I of course am speaking of the second overnight and global meltdown of the credit markets …in the last four business days! Before getting into this topic which I believe will soon be seen in retrospect and by historians far into the future as “THE” trigger event. Just as we saw last Wed. …

Why The Powers That Be Are Pushing A Cashless Society

Martin Armstrong summarizes the headway being made to ban cash, and argues that the goal of those pushing a cashless society is to prevent bank runs … and increase their control: The central banks are … planning drastic restrictions on cash itself. They see moving to electronic money will first eliminate the underground economy, but secondly, they believe it will even prevent …

The “War on Cash” in 10 Spine-Chilling Quotes – Don Quijone

The war on cash is escalating. As Mises’ Jo Salerno reports, the latest combatant to join the fray is JP Morgan Chase, the largest bank in the U.S., which recently enacted a policy restricting the use of cash in selected markets; bans cash payments for credit cards, mortgages, and auto loans; and disallows the storage of “any cash or coins” …