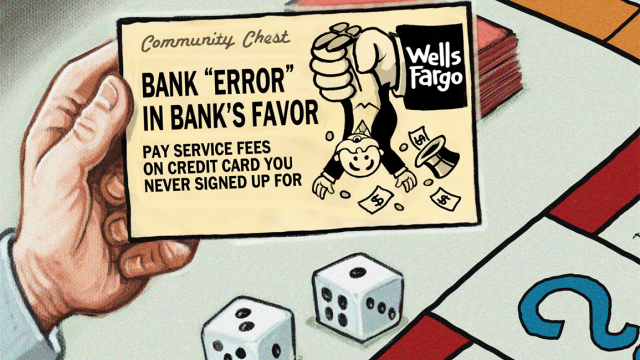

Last Thursday, the Consumer Financial Protection Bureau (CFPB) announced that Wells Fargo was paying $185 million in fines and penalties for allowing its employees to open “more than two million deposit and credit card accounts” that were not authorized by its customers. The employees were attempting to “hit sales targets and receive bonuses.” In one of the most audacious forms of …

SIMON LAZARUS – Don’t Just Whack Wells Fargo’s CEO

Too-big-to-fail Wells Fargo, with its too-big-to-whitewash scheme of charging customers for two million bogus accounts, has done something consumer champions have seldom accomplished on their own: showing ordinary Americans that even the most respected big corporations can opt for blatant, systematic cheating if their leaders believe they can get away with it. Even the banking industry’s most reliable defenders, the …

Pam Martens and Russ Martens – The Debate Is Over: Banking Has Become a Criminal Enterprise in the U.S.

Tomorrow the U.S. Senate Banking Committee will hold a hearing to take testimony from Wells Fargo CEO John Stumpf and Federal regulators to understand how this mega bank was able to get away with opening more than two million fake customer accounts over a span of years. The accounts and/or credit cards were never authorized by the customer and were …

Our Giant Experiment With “Greed Is Good” Has Failed

Another day, another example of the disastrous effect Reaganomics has had on our country’s business culture. Ever since his bank was fined $185 million for illegally opening millions of accounts in its customers’ names to help boost profits, Wells Fargo CEO John Stumpf has insisted that he only discovered what was going on in 2013. That’s what he said when …

LAINEY HASHORVA – WELLS FARGO WHISTLEBLOWER: “THEY ARE ALL RIDING THE STAGECOACH TO HELL”

It has been and continues to be an interesting week for Wells Fargo, with widespread coverage from mainstream news outlets; John Stumpf, Wells Fargo’s CEO, going before Congress on September 20; and a $185 million settlement announced with the Consumer Financial Protection Bureau. Interesting, then, that despite all of the monies paid in fines to the CFPB, Wells Fargo still …