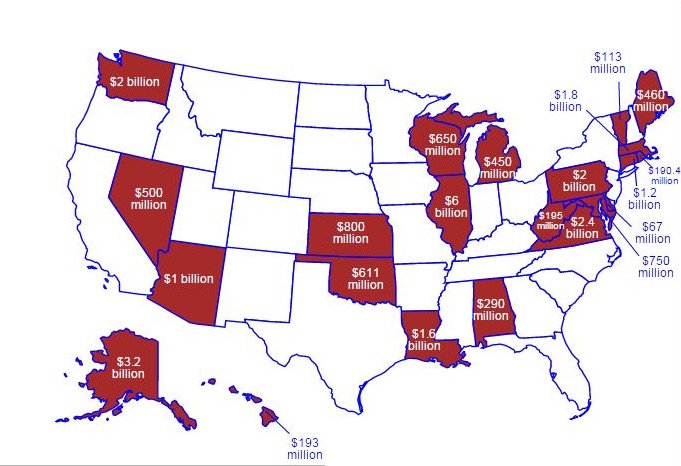

Last month, we documented the case of Louisiana State University, the large, well-known public institution whose 2014 enrollment totaled nearly 31,000 students. LSU, it turns out, is facing funding cuts of as much as 82% which, if realized, would likely force the school into financial exigency, the college equivalent of bankruptcy. The reason for the cuts: the sharp decline in oil prices and fiscal mismanagement have conspired to blow a $1.6 billion hole in the state’s budget.

Bloomberg has more:

With tax revenue from the oil industry falling short of projections, the deficit has swelled to $1.6 billion for the fiscal year that starts July 1. Moody’s Investors Service and Standard & Poor’s say they may lower Louisiana’s credit rating if officials don’t come up with sustainable budget solutions.

Louisiana paid the price when it sold $335 million of general obligations Wednesday, its first deal this year. Borrowing costs jumped compared with an issue in November, with the yield spread more than doubling on some maturities.

“They have to make significant cuts across the board — it’s almost a foregone conclusion they’ll be downgraded,” said Tom Metzold, co-director of municipal investments in Boston at Eaton Vance Management, which oversees $25 billion in local debt.