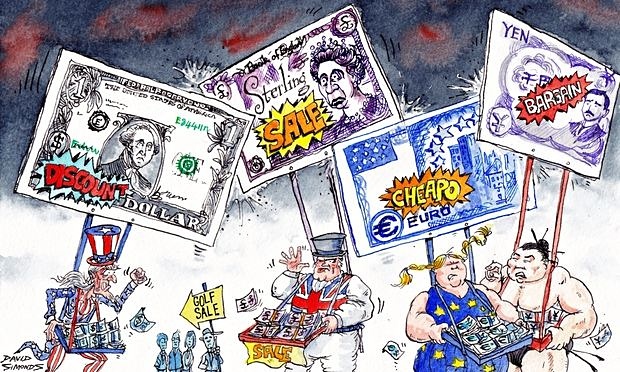

Jack reviews the most recent threat by Europe’s central bank to expand its ‘quantitative easing’ program in order to gain share of a slowing global trade pie. As the global economy slows and competition for exports intensifies from China to US to Japan to Europe, the European Central Bank announces plans to expand its $1.1 trillion free money program for bankers and investors. Jack explores the possible consequences of the likely decision: Japan will no doubt follow with further expansion of its own QE program to defend its share of global exports. The US federal reserve, its central bank, will be less likely to raise interest rates in turn—as US exports and manufacturing are already close to stagnating, and reducing US GDP. Simultaneously, China announces its sixth cut in interest rates. Major sectors of the global economy and intensifying competition over a shrinking global economy. Jack also updates recent Alternative Visions shows on the TPP, Big Pharmaceutical companies’ price gouging, and the Chrysler-Auto Workers recent negotiations. With TPP almost a done deal, now corporate America, Jack predicts, will focus on its second big objective: corporate tax cuts. How US multinational tech and pharma companies play the global tax avoidance game is explained.