The big global banks have begun to warn clients that the blistering rally in oil and industrial commodities in recent weeks has run far ahead of economic reality, raising the risk of a fresh slump in prices over the summer.

Barclays, Morgan Stanley and Deutsche Bank have all issued reports advising investors to tread carefully as energy and base metals fall prey to unstable speculative flows in the derivatives markets.

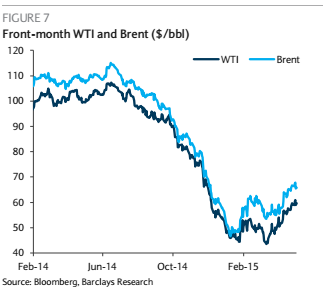

Oil has jumped 40pc since January even as the US, China and the world economy as a whole have been sputtering, falling far short of expectations.

“Watch out: this rally may not last. The risks for a reversal in recent commodity price trends are growing,” said analysts at Barclays.

“There is a huge disconnect between the price action in physical markets where differentials are signalling over-supply and the futures markets where all looks rosy.”

Miswin Mahesh, the bank’s oil strategist, said a glut of excess oil is emerging in the mid-Atlantic, with inventories rising at a rate of 1m barrels a day (b/d). Angola and Nigeria are sitting on 80m barrels of unsold crude and excess cargoes are building up in the North Sea and the Mediterranean.

Morgan Stanley echoed the concerns, warning that speculators and financial investors have taken out a record number of “long” positions on Brent crude on the futures markets even though the world economy keeps falling short of expectations. “We have growing concerns about crude fundamentals in the second half of 2015 and 2016,” it said.