Some people talk about peak energy (or oil) supply. They expect high prices and more demand than supply. Other people talk about energy demand hitting a peak many years from now, perhaps when most of us have electric cars.

Neither of these views is correct. The real situation is that we right now seem to be reaching peak energy demand through low commodity prices. I see evidence of this in the historical energy data recently updated by BP (BP Statistical Review of World Energy 2015).

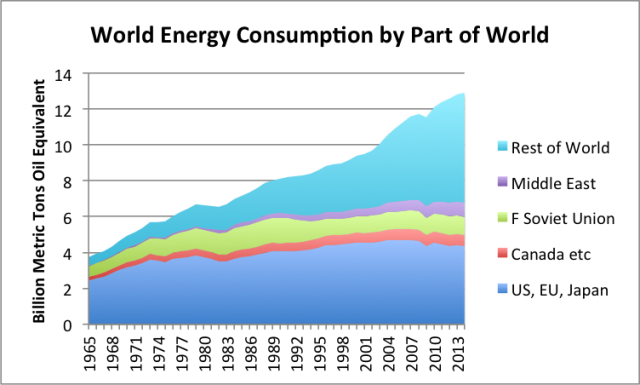

Growth in world energy consumption is clearly slowing. In fact, growth in energy consumption was only 0.9% in 2014. This is far below the 2.3% growth we would expect, based on recent past patterns. In fact, energy consumption in 2012 and 2013 also grew at lower than the expected 2.3% growth rate (2012 – 1.4%; 2013 – 1.8%).

Recently, I wrote that economic growth eventually runs into limits. The symptoms we should expect are similar to the patterns we have been seeing recently (Why We Have an Oversupply of Almost Everything (Oil, labor, capital, etc.)). It seems to me that the patterns in BP’s new data are also of the kind that we would expect to be seeing, if we are hitting limits that are causing low commodity prices.

One of our underlying problems is that energy costs have risen faster than most workers’ wages since 2000. Another underlying problem has to do with globalization. Globalization provides a temporary benefit. In the last 20 years, we greatly ramped up globalization, but we are now losing the temporary benefit globalization brings. We find we again need to deal with the limits of a finite world and the constraints such a world places on growth.