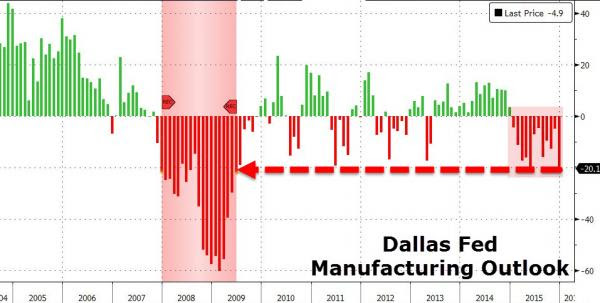

After a Q1 collapse, the Dallas Fed Manufacturing Outlook managed a bounce for a few months (though never got back above zero). It appears, Dallas Fed’s aptly-named ‘Dick’ Fischer was entirely wrong when he progonosticated that “on net, low oil prices are good for Texas.” December’s Dallas Fed print crashed to -20.1 (from -4.9) massively missing expectations of -7.0 and back at the lows not seen since June 2009.

“The price of oil is really impacting our customer base and, in turn, purchases of our product. It is getting ugly.”

There are lots of contradictions in the marketplace. As an offshore oil service provider, we have had very strong orders for the last five months, which is bizarre. We continue to read about doom and gloom, but the numbers haven’t borne that out. Living in Houston, I continue to see multiple out-of-state license plates on the freeways. People are continuing to pour into Houston; I just don’t know what they’re doing.