Despite the practical failures of free-market economics, too many mainstream economists have continued to embrace simplistic ideas about how the economy works. Such ideas are often rooted more in ideology than in evidence. These beliefs and the policies that follow led directly to the 2008 financial crisis and the Great Recession. They also centrally contributed to the nation’s subpar performance beginning in the late 1970s, and to our widening inequality. They continue to endanger America’s economic health.

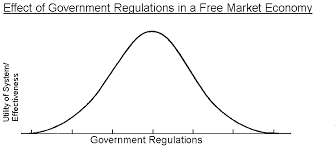

The mainstream of the profession claims to qualify oversimplified free-market ideas. But when it comes to key policy choices, the premise that markets are efficient usually trumps a more complex analysis. Thus, most mainstream economists are usually for less regulation even when more is required. They argue for reducing deficits even when expanded public outlay is indicated. They favor letting markets set wages without many safeguards for workers, even when the result proves neither equitable nor efficient. The consensus in the profession is that widening inequality must be the result of deficiencies in the skills of the workforce, rather than the result of structural disadvantages inadequately addressed by government.