It is well enough that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. — Attributed to Henry Ford

In March 2014, the Bank of England let the cat out of the bag: money is just an IOU, and the banks are rolling in it. So wrote David Graeber in The Guardian the same month, referring to a BOE paper called “Money Creation in the Modern Economy.” The paper stated outright that most common assumptions of how banking works are simply wrong. The result, said Graeber, was to throw the entire theoretical basis for austerity out of the window.

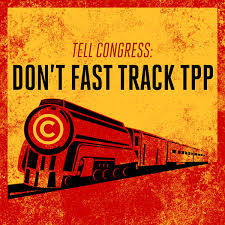

The revelation may have done more than that. The entire basis for maintaining our private extractive banking monopoly may have been thrown out the window. And that could help explain the desperate rush to “fast track” not only the Trans-Pacific Partnership (TPP) and the Trans-Atlantic Trade and Investment Partnership (TTIP), but the Trade in Services Agreement (TiSA). TiSA would nip attempts to implement public banking and other monetary reforms in the bud.