The Atlantic called millennials the “unluckiest generation,” and there’s no denying today’s young adults had the misfortune of graduating into a recession. Slatecalculated that stagnant incomes and mounting student loans are putting young people “deep in a hole.” If you include those who have given up searching, the unemployment rate for 18-29 year-olds reached 15 percent last September. And aDemos poll found alarming rates of young Americans who say their financial situations have caused them to delay major life steps like purchasing a home (46 percent), moving out on their own (33 percent), starting a family (30 percent) or getting married (25 percent).

But there’s more to the story than the economy and bad timing. Congress could take specific action to relieve some of the burdens off young Americans, but it won’t happen as long as lawmakers continue to prioritize the interests of rich corporations and the super-wealthy. Here are four ways the oversized role of money in politics is hurting millennials:

1. Student Loan Debt

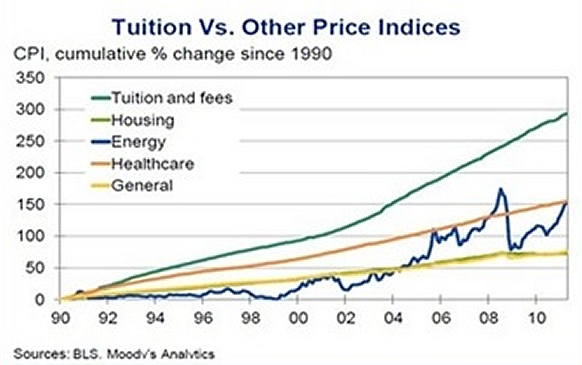

More than 70 percent of the class of 2014 graduated with outstanding loans, owing a record average of $33,000 each. That brought total student debt to $1.1 trillion, surpassing the total debt from auto loans and credit cards. It’s no surprise that in a poll conducted last year, 79 percent of millennials said the government should be more involved in making college affordable.

In the wake of what is obviously a crisis for young Americans, Congress has repeatedly introduced reform legislation, such as the Private Student Loan Bankruptcy Fairness Act, the Fairness for Struggling Students Act, and Sen. Elizabeth Warren’s 2013 Bank on Students Loan Fairness Act, which would havelowered interest on federal student loans (currently 4.66 percent) to the same 0.75 percent enjoyed by banks.

Why hasn’t Congress passed any of these bills and thrown a lifeline to struggling college grads? Perhaps it has something to do with the $4.5 million the student loan industry poured into lobbying efforts last year, or the $1 million it made in political contributions. Sallie Mae alone has spent about $3 million every year since 2007 lobbying against bills that would ease the burden on college grads.

When college lenders blocked a seemingly sure-to-pass 2010 overhaul of the student loan industry — in what The New York Times called an “aggressive” lobbying campaign — Secretary of Education Arne Duncan was unsurprised by their efforts, commenting, “They’ve had this phenomenal deal that taxpayers have subsidized, and that’s a hard thing to give up.”

2. Climate Change