One of the biggest banks in the Middle East and the oil-rich Gulf countries says that fossil fuels can no longer compete with solar technologies on price, and says the vast bulk of the $US48 trillion needed to meet global power demand over the next two decades will come from renewables.

The report from the National Bank of Abu Dhabi says that while oil and gas has underpinned almost all energy investments until now, future investment will be almost entirely in renewable energy sources.

The report is important because the Gulf region, the Middle East and north Africa will need to add another 170GW of electricity in the next decade, and the major financiers recognise that the cheapest and most effective way to go is through solar and wind. It also highlights how even the biggest financial institutions in the Gulf are thinking about how to deploy their capital in the future.

“Cost is no longer a reason not to proceed with renewables,” the 80-page NBAD report says.It says the most recent solar tender showed that even at $10/barrel for oil, and $5/mmbtu for gas, solar is still a cheaper option.

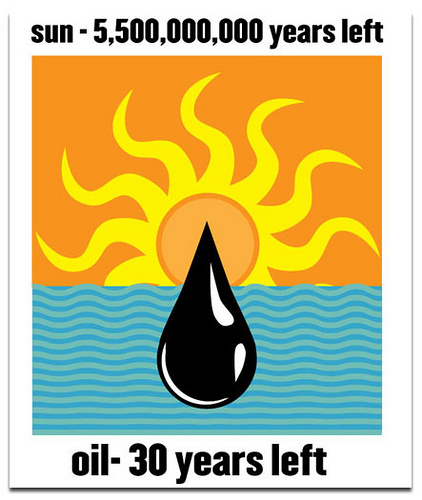

The bank says intermittency of wind and solar is not an issue, notes that fossil fuels resources are finite and becoming increasing hard to reach, notes that governments want local supplies and want to disconnect from the volatility of the oil price, and says policy frameworks are seeking to decarbonise economies in response to climate and pollution concerns.