Oil analysts and commodity traders watch the price of crude swing down and up, and are trying to figure out when and to what extent the OPEC “price war” will force supply reductions from US shale. Any insight into this development can clarify the trajectory of oil prices.

But, of course, oil market dynamics are complex and fluid. US shale supply is hugely important for oil prices, but one of the more underreported factors influencing the price of oil is the pace of demand growth coming from China.

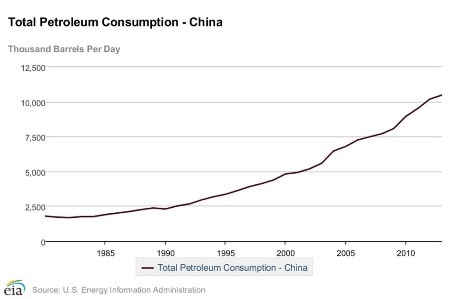

Consumption of oil in China has climbed rapidly and consistently since it took off in 1990, accelerating into overdrive in the 2000s. The inexorable surge in demand caused oil markets to tighten in the lead up to the financial crisis, and then again in subsequent years as the global economy recovered.