Surging student-loan debt represents a key risk to the economy’s expansion because wage gains are failing to keep up, according to Beth Ann Bovino, U.S. chief economist at Standard & Poor’s.

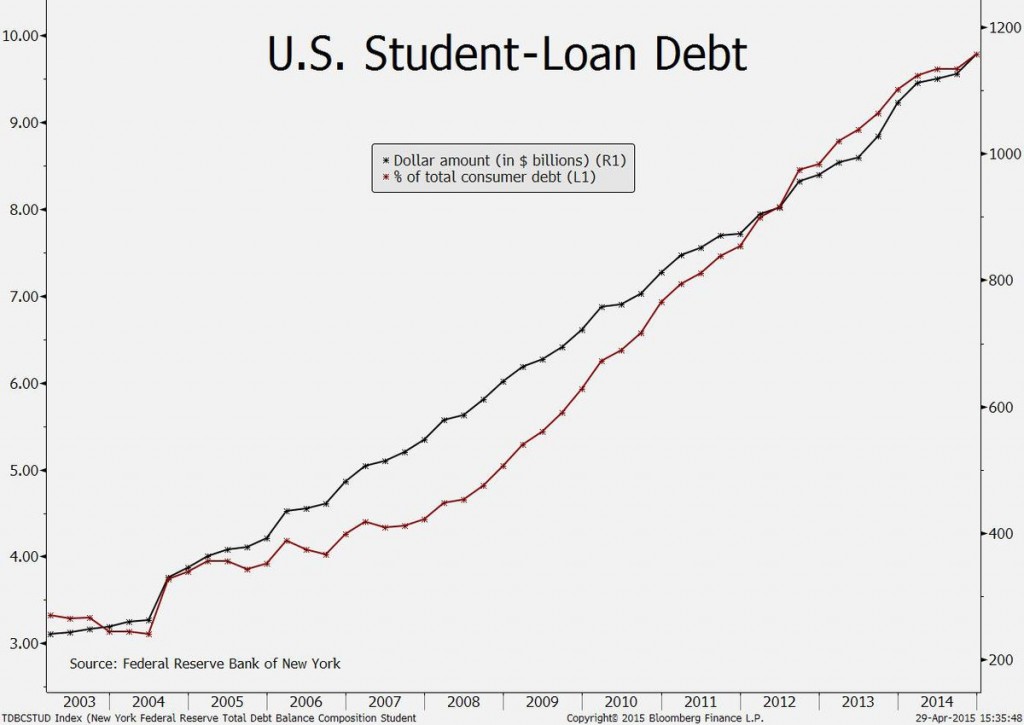

As the attached chart illustrates, the dollar amount of borrowing has increased in each quarter since 2003, when data compiled by the Federal Reserve Bank of New York begins. The chart also displays student loans as a percentage of consumer debt, which has consistently risen since 2007’s third quarter.

Education-related loans amounted to $1.16 trillion at the end of last year, a 71 percent increase from the second quarter of 2009, when the latest recession ended. The growth contrasted with declines in mortgages, home-equity loans, credit cards and other forms of consumer borrowing.

“Millennials’ heavy student-loan burdens could seriously crimp spending,” Bovino wrote yesterday in a report. “This is not a future anyone wants to see.” She defined millennials as Americans born between the early 1980s and the early 2000s and cited an estimate that they account for about 60 percent of education debt.