Prof. Laurence Shoup is a historian who has been researching the background and agendas of the Council on Foreign Relations for 40 years. He has…

Bank of Japan

- Home/

- Tag/

- Bank of Japan/

Gerald Celente breaks down how the talking airheads on business broadcast media keep missing the larger picture of crumbling worldwide economies and the undeniable underlying…

Dr. Jack Rasmus is a professor of political economics at St. Mary’s College and Santa Clara University in California. Prior to teaching, he was an…

The following text is an English transcript (translation) of an RT Berlin Interview in German regarding an apparent secret agreement between the European Central Bank (ECB)…

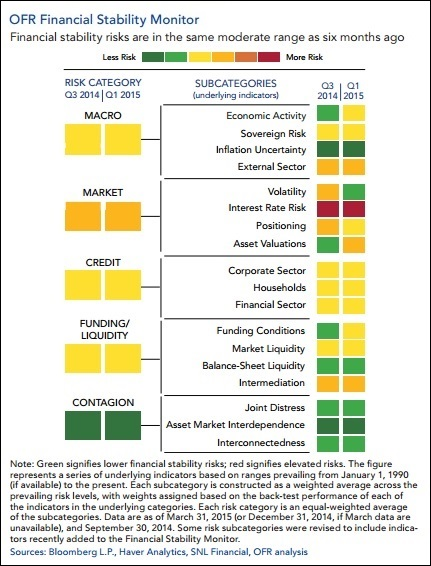

Remember when the Department of Homeland Security was issuing those color-coded terrorist alerts? Well, they don’t do that anymore. They’re back to using plain ole black-and-white…

Back in November we chronicled the (quiet) death of the Petrodollar, the system that has buttressed USD hegemony for decades by ensuring that oil producers recycled their…

The stock market is rigged. When I started making that claim years ago — and provided solid evidence — people scoffed. Some called it a…

As first reported by Forbes, the International Monetary Fund (IMF) dropped a bomb in its October Fiscal Monitor Report. The report paints a dire picture for…

Are there really secret manipulations of the economy going on in the shadows of Wall Street and Washington? Do bears crap in the woods? The NY Post’s…