Tomorrow the U.S. Senate Banking Committee will hold a hearing to take testimony from Wells Fargo CEO John Stumpf and Federal regulators to understand how…

Bank

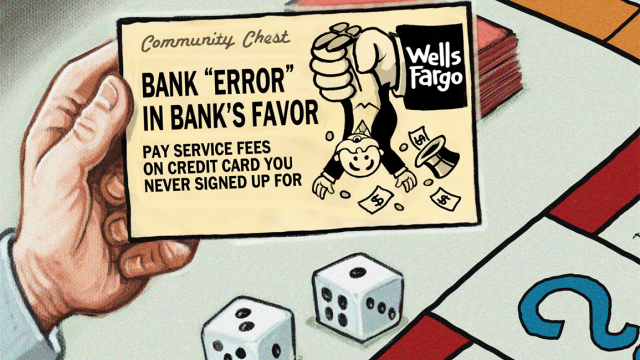

Another day, another example of the disastrous effect Reaganomics has had on our country's business culture. Ever since his bank was fined $185 million for…

It has been and continues to be an interesting week for Wells Fargo, with widespread coverage from mainstream news outlets; John Stumpf, Wells Fargo’s CEO,…

Last Thursday, the Consumer Financial Protection Bureau (CFPB) announced that Wells Fargo was paying $185 million in fines and penalties for allowing its employees to open “more…

Updates on Obamacare scandal, bank errors threaten depositors, public pension looting, subsidizing religion. Major discussion of old vs new meanings of capitalism as an economic…