Despite a bounce this week, low oil prices continue to sow fear, uncertainty, and mayhem across the emerging market complex. On Wednesday, it was leaked…

Brazilian real

Jack takes a look at the key economic developments of the past week, and then provides the first of a several part analysis this month…

-There are many thousands, of US government slugs posted in Latin America; contractors, embassy personal, military support, security people, clandestine operatives and more. Most of…

- How to determine if gringos have invaded or permanently spoiled yours or some other expat’s Latin Paradise -Bad first- world trends that are slowly…

Wall Street is again leading to the corridors of central banks. From Minneapolis to Paris, investors and financiers are increasingly being hired to help set…

-Today we have some eyewitness stories concerning thoroughly BAD gringos who’ve come down to Latin America to practice their perversions. Unfortunately, what makes Latin America…

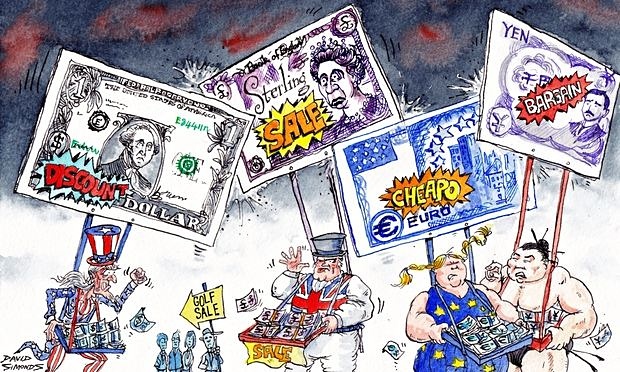

Jack reviews the most recent threat by Europe’s central bank to expand its ‘quantitative easing’ program in order to gain share of a slowing global…

The Federal Reserve is flailing and global currency markets are in disarray. Notably, the Brazilian real dropped more than 10% in five sessions, before Thursday’s…