IN PROTESTING the Treaty of Versailles ending World War I, John Maynard Keynes wrote: “The policy . . . of depriving the lives of millions of…

Bretton Woods system

In spite of the fierce opposition of the US treasury Department, on November 30 the IMF finally approved the inclusion of the yuan in the…

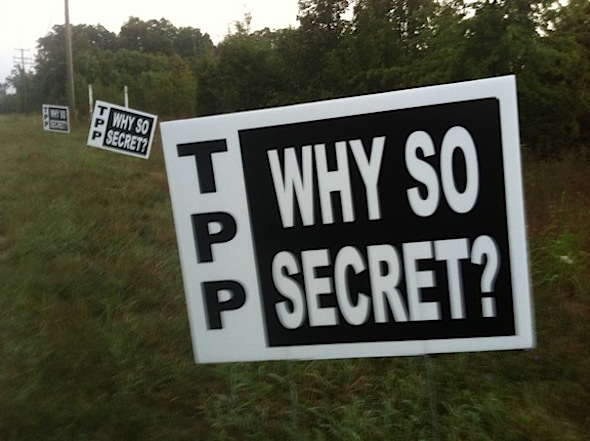

Jack Rasmus undertakes the first of a two part deep examination of the terms and conditions of the actual TPP agreement recently concluded. The origins…

Our debt-based monetary system conceals a brutal fact: indebtedness to private sources for the acquisition of money is an unnecessary scourge on our economy and…

The Chinese are in the process of displacing the monopoly of the US dollar. They are dropping their US Treasury bonds, stockpiling gold reserves, and…

The title is of course a little misleading because China has many options, none of which except one in my opinion will actually work. Options…

The financial media as well as segments of the alternative media are pointing to a possible weakening of the US dollar as a global trading…