As the euphoria of the false promise of Trump policies stimulating US economic growth continue to fade, host Dr. Jack Rasmus reviews several economic reports…

Christine Lagarde

Score one for the post-colonial underdog. India’s economy has reportedly overtaken the United Kingdom’s for the first time in over 100 years, now standing as…

From Britain’s vote to leave the European Union to Donald Trump’s championing of “America First,” pressures are mounting to roll back the economic integration that…

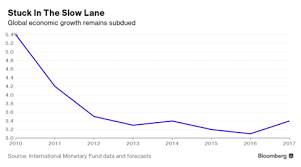

The International Monetary Fund has revised down its estimates for the US and other advanced economies for this year while maintaining its forecast for global…

Deutsche Bank’s shares plunged to record lows this week, sparking talk of a government bailout to avert a new financial crash. The turmoil surrounding Germany’s…

Before the externally-orchestrated dirty war on Syria started with the externally-orchestrated “Arab Spring” psy op; before the “peaceful protestors” shot the unarmed Syrian security forces;…

Two months after consultancy giant McKinsey dramatically flip-flopped on its long held position of praising globalization, cautioning that - as Britain's vote to exit the European Union…

Dr. Jack Rasmus summarizes his just published book this month, ‘Looting Greece: A New Financial Imperialism Emerges’, Clarity Press, Sept. 2016, explaining how debt and…

Dr. Rasmus discusses the first of a two part series on the nature of Greek debt crises, and how they are the consequence of Euro…

Remember when Bitcoin and its digital currency cohorts were slammed by authorities and written off by the elite as worthless? Well now, as the war…

With New Year celebrations barely in the rear view mirror, foreboding storm clouds are once again forming along the horizon. The blackening skies are casting…

NEW YORK – The year 2015 was a hard one all around. Brazil fell into recession. China’s economy experienced its first serious bumps after almost…