The top ten banks in the U.S., along with their European counterparts have racked up over $300bn of fines, metered out by regulators since their…

A new report released Tuesday reveals how "U.S.-based multinational corporations are allowed to play by a different set of rules than small and domestic businesses…

Deutsche Bank’s shares plunged to record lows this week, sparking talk of a government bailout to avert a new financial crash. The turmoil surrounding Germany’s…

Turning their backs on climate science and the consensus of governments and civil society across the globe, the world's biggest banks are dangerously advancing the…

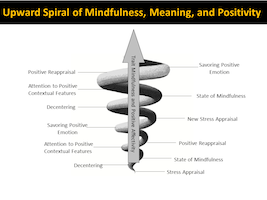

Those darn spirals! When they're positive spirals, they feel great. It feels like you can't do anything wrong. But the negative spirals are the worst.…

Don't the buy the media line that the volatility in global markets is all about oil. It's not. Not even close. The fast-moving meltdown in…

The $15 trillion rout in global equity markets since May is reawakening the lure of gold for investors seeking safety. Hedge funds and other large…

The conventional wisdom was that the Fed’s rate hike on December 16 of last year was going to help big bank stocks by boosting their…

Prior to the 2008 financial crisis, the Federal Reserve had an important role - to solely act as a "lender of last resort" to traditional…

Jack takes a look at the key economic developments of the past week, and then provides the first of a several part analysis this month…

Ukraine is headed straight toward a full-scale default on its public debt, which currently totals $70 billion, of which $40 billion is owed to foreign…

While the U.S. taxpayer was involuntarily shoveling over $2 trillion in bailout funds and loans into Citigroup from 2008 to 2010, the bank was committing…