Amid soaring inequality [3] and stagnant wages [4], consumers in the United States collectively accumulated a stunning $34.4 billion in credit card debt during the second quarter of 2016 alone,…

Credit card debt

Interview with Odysseas Papadimitriou, CEO of CardHub, on their latest study examining the accelerating increase in credit card debt levels, why he thinks this is…

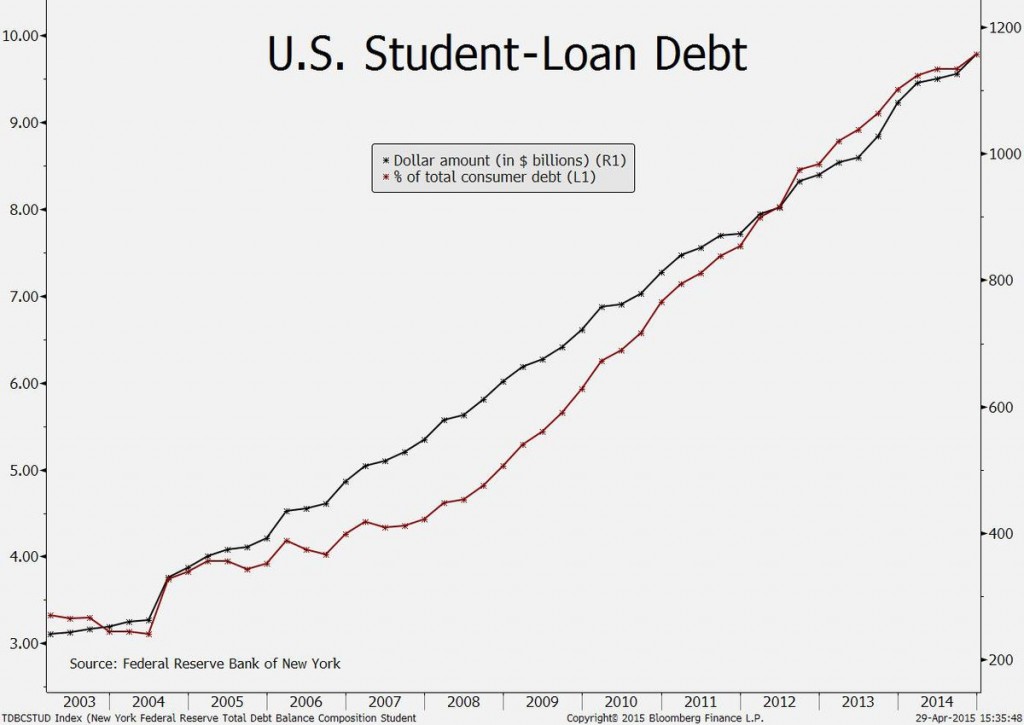

Surging student-loan debt represents a key risk to the economy’s expansion because wage gains are failing to keep up, according to Beth Ann Bovino, U.S.…

When it comes to what goes on in the marble corridors of the Federal Reserve, Americans tend to be suspicious. For different reasons, both the…