Today's program features a discussion on the Brexit vote. Vince talks about what the vote means, and what it doesn't mean. He also explores procedural…

Economic

Global master forecaster Gerald Celente analyzes the state of the presidential race as he reflects on the state of America's decline in the 21st Century…

The Federal Reserve operates the largest printing press on the planet. It seeks to hire the most qualified people to address current economic conditions and…

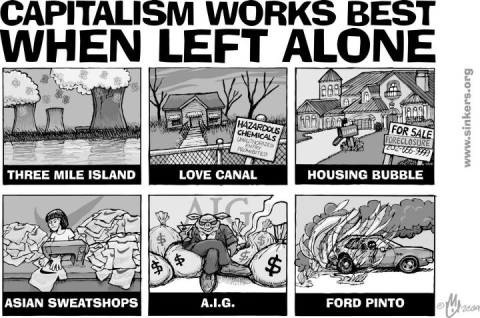

Updates on Obamacare scandal, bank errors threaten depositors, public pension looting, subsidizing religion. Major discussion of old vs new meanings of capitalism as an economic…

Updates on capitalism vs higher education, real costs of apps, how other half banks. In depth analyses of projected economic downturn in 2016, capitalist inequality…