Dr. Jack Rasmus looks at today’s, and this past week’s, plunge in global stock markets from Shanghai to New York and beyond. What’s driving the…

Economy of the People’s Republic of China

When the banking crisis crippled global markets seven years ago, central bankers stepped in as lenders of last resort. Profligate private-sector loans were moved on…

Peter Schiff, CEO of Euro Pacific Capital and bestselling author of “Crash Proof,” believes the impending collapse of the United States dollar should be getting…

Every quasi-mushroom cloud has a silver lining. That was our cynical conclusion yesterday when we noticed that as part of China's tragic Tianjin mega-explosion, thousands…

The world economy is disturbingly close to stall speed. The United Nationshas cut its global growth forecast for this year to 2.8pc, the latest of the…

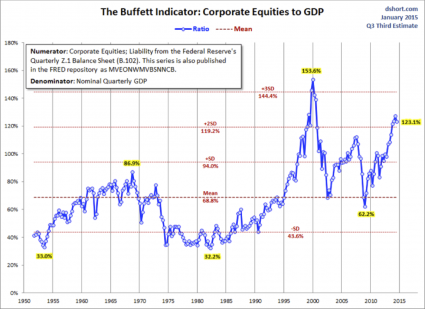

The higher financial markets rise, the harder they fall. By any objective measurement, the stock market is currently well into bubble territory. Anyone should be…

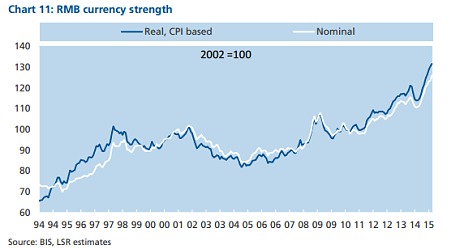

The Chinese do not plan to live in a world dominated by the U.S. dollar for much longer. Chinese leaders have been calling for the…