Much has been written and broadcast over the past few weeks in the financial media and the business pages of general-interest newspapers debating the wisdom…

Financial crisis of 2007–2008

A lot of people were expecting some really big things to happen in 2015, and most of them did not happen. But what did happen? …

The following text is the forward to Ernst Wolff‘s book entitled : Pillaging the World. The History and Politics of the IMF, Tectum Verlag Marburg,…

Economic forecasting is a mug’s game. One thing that has been learned from the financial crisis and Great Recession is that even those equipped with…

The following is an excerpt from the introduction to Shadow Sovereigns: How Global Corporations are Seizing Power: We're surrounded. Everywhere you look you find masses,…

The elevation the Chinese renminbi (also known as the yuan) to the basket of global currencies making up the International Monetary Fund’s special drawing rights…

Wall Street is again leading to the corridors of central banks. From Minneapolis to Paris, investors and financiers are increasingly being hired to help set…

What have governments learnt from the financial crisis? I could write a column spelling it out. Or I could do the same job with one…

Corporate-friendly international agreement like TPP and TTIP, writes Monbiot, "could scarcely be better designed to exacerbate and universalise our multiple crises – financial, social and…

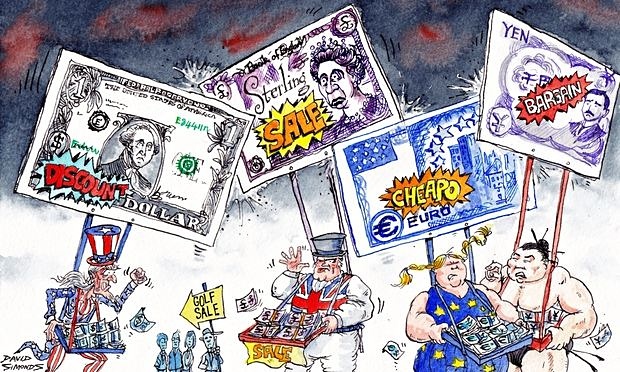

Jack reviews the most recent threat by Europe’s central bank to expand its ‘quantitative easing’ program in order to gain share of a slowing global…

The United States (US) government often cites $18 trillion as the amount of money that they owe, but their actual debts are higher. Much higher.…

The financial markets have been through some wild and crazy times over the last two weeks, although it appears that they have finally stabilized. The…