A global shift to more insecure jobs since the financial crisis is fuelling growing inequality and higher rates of poverty, according to a new report…

Financial crisis of 2007–2008

Is it any wonder that fewer people these days are willing to trust the US federal government or their American leader President Obama? The citizen…

It seems hard to believe, but your government is purposely recreating the mortgage debacle of 2007 and putting you on the hook for the billions…

Greek ministers are spending this weekend, almost five grinding years since Athens was first bailed out, wrangling over the details of the spending cuts and…

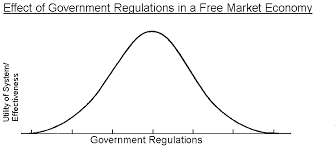

Despite the practical failures of free-market economics, too many mainstream economists have continued to embrace simplistic ideas about how the economy works. Such ideas are…