One noteworthy feature of Brexit coverage is British commentators and even worse, officials, reassuring themselves and their audiences that the EU’s firm insistence that the…

Financial Markets

Jack discusses the global bond market conditions today, many times the size of the world’s stock markets and far more important. Bond guru, Bill Gross,…

In the United States, disaster has become our most common mode of life. Proof that our daily existence was something other than a simmering, smoldering…

Be reasonable in response to the unreasonable: this is what voters in the Labour election are told. Accommodate, moderate, triangulate, for the alternative is to…

Ed Kane, a professor of finance at Boston College and grantee at the Institute for New Economic Thinking [3], studies the dangerous risk-taking of giant banks. He…

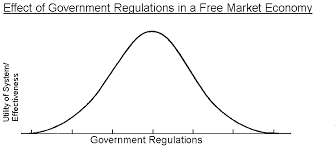

Despite the practical failures of free-market economics, too many mainstream economists have continued to embrace simplistic ideas about how the economy works. Such ideas are…