There’s a new Markopolos in town with that same brand of leave-no-stone-unturned tenacity and he has his sights set on the charity operations of Hillary…

Jpmorgan Chase

The leading expert on food at the United Nations says sharp price fluctuations in the price of food has little to do with actual supply.…

Daniel Pinto, CEO of JPMorgan's corporate and investment bank, just made a gloomy prediction for Wall Street. He said that the firm's investment-banking revenues are forecast…

Just days after a Bernie Sanders campaign ad singled out Goldman Sachs as "one of the Wall Street banks that triggered the financial meltdown," the head of…

Last month as Hillary Clinton was leaving a town meeting in Manchester, Lee Fang of the Intercept asked her if she would release the transcripts…

The $15 trillion rout in global equity markets since May is reawakening the lure of gold for investors seeking safety. Hedge funds and other large…

While Edward Snowden and Chelsea Manning and John Kiriakou are vilified [3] for revealing vital information about spying and bombing and torture, a man who conspired [4] with Goldman Sachs to…

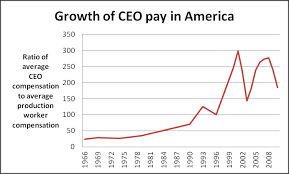

America, chief executive pay is now 300 times more than the average worker. That’s a high enough ratio that presidential candidates are taking note on…

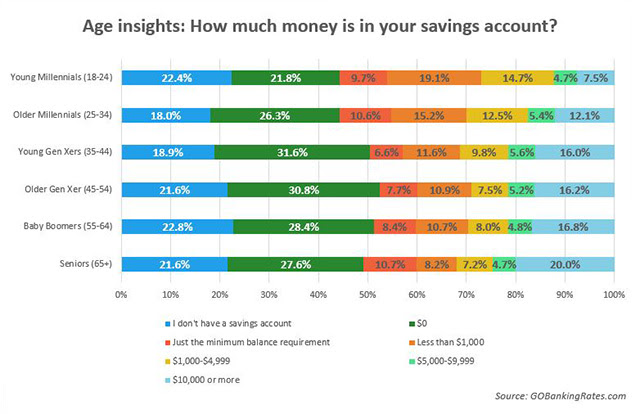

Two recent surveys, along with numerous other studies and data, reveal most American households to be living on the brink of catastrophe, but continuing to…

Obama’s Education Secretary Quits; Attack on Public Schools Won’t A Lead-Poisoned River Runs Through It: Water Woes in Flint, Michigan Ferguson, Missouri, Being Readied for…

I suppose much of the journo commentariat was born since 2008 and therefore has no memory of TARP, Too Big To Fail, or Jamie Dimon…

This article establishes that the price of gold and silver in the futures markets in which cash is the predominant means of settlement is inconsistent…