Download this episode (right click and save) Dr. Rasmus dedicates today’s show to examining the condition of financial bubble and growing instability in global financial markets. …

Mario Draghi

- Home/

- Tag/

- Mario Draghi/

Dr. Jack Rasmus reviews recent developments in the growing instability in Germany’s largest bank, Deutsche Bank, and explains how it is a reflection of a…

Populist movements - real populist movements, not the "pop" populism trumped in the U.S. - are building momentum across the globe. Gerald Celente breaks down…

Should we be alarmed that the number of job cuts announced by large U.S. companies was 35 percent higher in April than it was in…

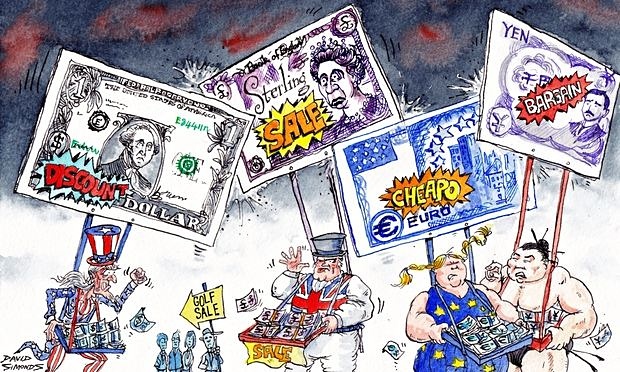

China is blowing an even bigger industrial-growth bubble, central banks are attempting to prevent a global shock, and, meanwhile, all eyes are on the US…

With every passing day, the Fed is slowly but surely losing the game. Only it is not just former (and in some cases current) Fed presidents…

oday, 2nd April 2016, WikiLeaks publishes the records of a 19 March 2016 teleconference between the top two IMF officials in charge of managing the Greek debt…

Last month the Bank of Japan (BoJ) expanded its QE program and negative interest rates (NIRP) in a desperate attempt to reboost its stock market…

Jack Rasmus comments on the worried commentary about the global economy today coming out of this week’s World Economic Forum in Davos, Switzerland. The annual…

The following text is an English transcript (translation) of an RT Berlin Interview in German regarding an apparent secret agreement between the European Central Bank (ECB)…

Jack Rasmus looks at yesterday’s decision by the European Central Bank to make token changes to its QE policies, Japan’s central bank rumors of more…

Jack reviews the most recent threat by Europe’s central bank to expand its ‘quantitative easing’ program in order to gain share of a slowing global…