In the past year the stock markets in China erupted, contracting by nearly 50% in just three months, after having risen in the preceding year…

People’s Bank of China

Jack Rasmus comments on the worried commentary about the global economy today coming out of this week’s World Economic Forum in Davos, Switzerland. The annual…

William White is one of the world’s top economists. He was the head economist for the Bank for International Settlements (BIS) – the world’s most…

So the slide continues with no end in sight. As expected this morning, the oil price has fallen below $28 a barrel on the back…

After an eventful 2015, where we witnessed the first US rate hike in 9 years, crude oil dropping to 6 year lows, a dramatic selloff…

Did you know that there are 5 “too big to fail” banks in the United States that eachhave exposure to derivatives contracts that is in excess…

The stock market is down. It must be some crazy thing China has done. Those Communist countries just don’t understand how capitalism works. No, wait!…

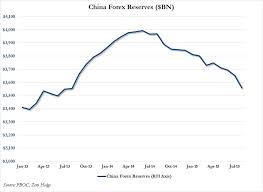

Shortly after the PBoC’s move to devalue the yuan, we noted with some alarm that it looked as though China may have drawn down its…

Housing markets are prone to the bandwagon effect, they continue rising when the fundamentals vanish, a year, maybe two years before. Stock market and commodity…

After the Fed admitted over a year ago that the US unemployment rate (which in 2012 was supposed to be a rate hike "threshold" once…

The Chinese are in the process of displacing the monopoly of the US dollar. They are dropping their US Treasury bonds, stockpiling gold reserves, and…

Last weekend, we explained why it really all comes down to the death of the petrodollar. China’s transition to a new currency regime was supposed to represent…