The American student loan crisis is often seen as a problem of profligacy and predation. Wasteful colleges raise tuition every year, we are told, even…

Student loan

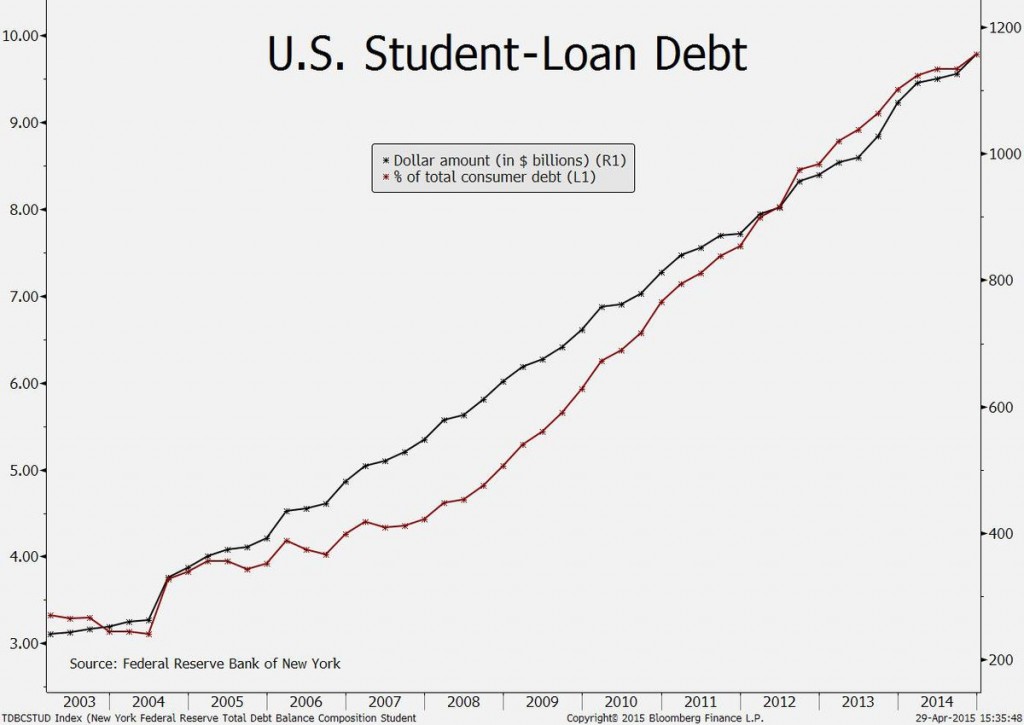

This September, millions of young Americans will start college, but at what cost? Each year, the collective student loan debt skyrockets as tuitions continue to…

It couldn’t be a sunnier, more beautiful day to exit your lives -- or enter them -- depending on how you care to look at…

"Framing private educational lending as a consumer protection issue makes it seem as if the root cause of the student debt problem is the predatory…

Surging student-loan debt represents a key risk to the economy’s expansion because wage gains are failing to keep up, according to Beth Ann Bovino, U.S.…

On Friday we asked if the student debt bubble was about to witness its 2007 moment. In July of that year, all three ratings agencies turned…

Kyle Craig wants to go to graduate school, but just being an undergraduate is already drowning him in debt. “I’ve got student loans just like…

With all of that job creation being claimed by the Obama administration and disseminated by mainstream media outlets as signs of a sustained recovery you’d…

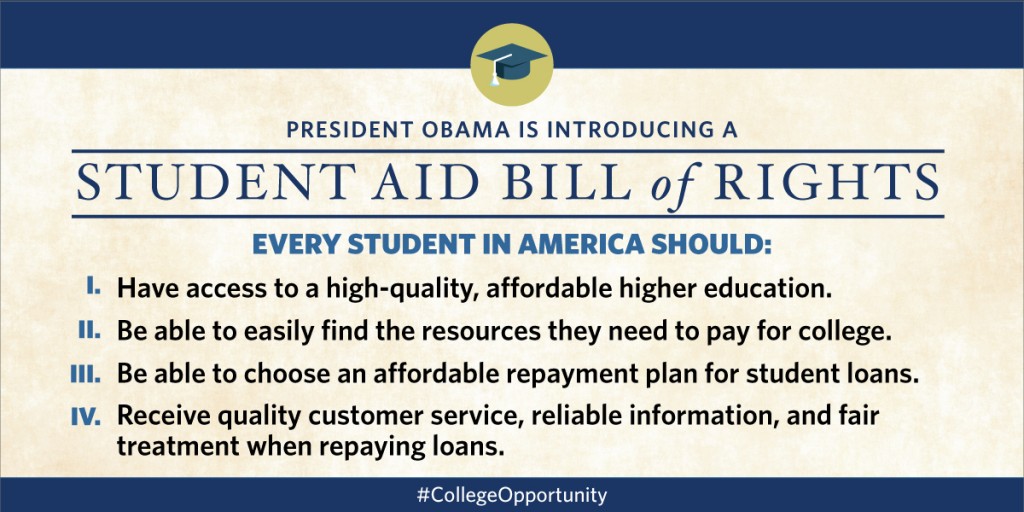

Last week President Obama announced a series of executive actions that he dubbed a “Student Aid Bill of Rights.” The initiative is partially an exercise…

In the month of February, fifteen former students of the for- profit Corinthian Colleges System declared they would no longer be paying off their sizable…

'Hell No, We Won't Go' — 1967 'No Way, We Won't Pay' — 2015 Fifty years ago students burned their draft cards to protest an immoral war…