We live in a world where the difference between assets and liabilities has been blurred. In the old days, an asset was something you “owned” while a liability was something you “owed”. Over the years as everything became securitized, someone else’s liability is now routinely someone’s asset but ONLY thought of as an asset. It has always been this way …

Cracking Down on Abusive Debt Collectors

Have you ever picked up your phone to find an aggressive voice on the other end demanding payments on a debt you know nothing about? You’re far from alone. Once you’re in the sights of a debt collector, the impact on your life can be devastating: Your wages can be garnished and your credit ruined. You might lose your driver’s …

KEVIN CAREY – Student Debt in America: Lend With a Smile, Collect With a Fist

The American student loan crisis is often seen as a problem of profligacy and predation. Wasteful colleges raise tuition every year, we are told, even as middle-class wages stagnate and unscrupulous for-profit colleges bilk the unwary. The result is mounting unmanageable debt. There is much truth in this diagnosis. But it does not explain the plight of Liz Kelley, a …

Bri Holmes – The Real Cost of Higher Education

This September, millions of young Americans will start college, but at what cost? Each year, the collective student loan debt skyrockets as tuitions continue to rise and graduates compete for scarce jobs with stagnant wages. From 2011 to 2013, the amount of debt held by recent graduates increased a whopping 20 percent, reaching a total more than $1.2 trillion. While Americans struggle to …

You’ve Been Scammed! By Tom Engelhardt

It couldn’t be a sunnier, more beautiful day to exit your lives — or enter them — depending on how you care to look at it. After all, here you are four years later in your graduation togs with your parents looking on, waiting to celebrate. The question is: Celebrate what exactly? In possibly the last graduation speech of 2015, …

The Student Loan Crisis and the Debtfare State – Susanne Soederberg

“Framing private educational lending as a consumer protection issue makes it seem as if the root cause of the student debt problem is the predatory practices of private educational lenders, distorting the role of the debtfare state,” writes Soederberg. In fact, federal government “has played a critical role in the construction and normalization of students’ increased reliance on loans—both public …

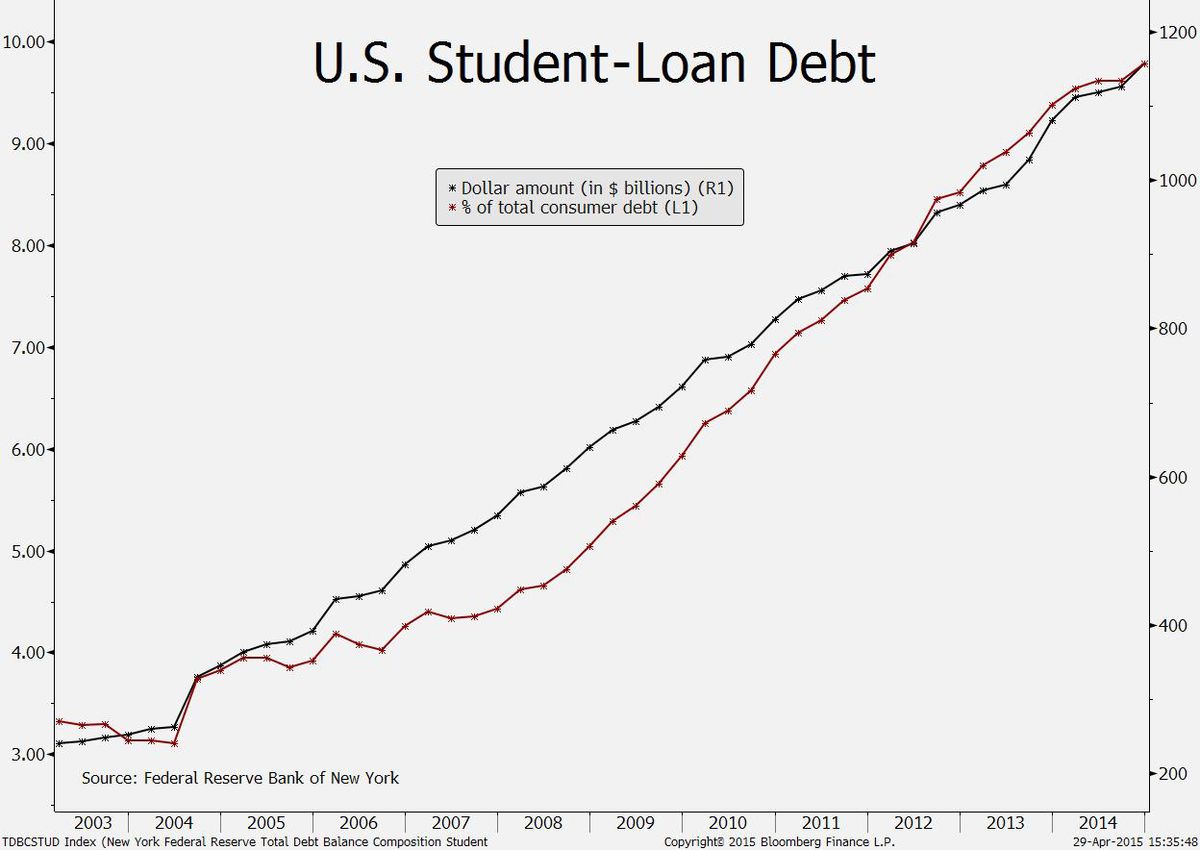

Student-Loan Surge Undercuts Millennials’ Place in U.S. Economy – David Wilson

Surging student-loan debt represents a key risk to the economy’s expansion because wage gains are failing to keep up, according to Beth Ann Bovino, U.S. chief economist at Standard & Poor’s. As the attached chart illustrates, the dollar amount of borrowing has increased in each quarter since 2003, when data compiled by the Federal Reserve Bank of New York begins. …

Student Debt Accounts For Nearly Half Of US Government “Assets” – Tyler Durden

On Friday we asked if the student debt bubble was about to witness its 2007 moment. In July of that year, all three ratings agencies turned aggressively negative on subprime-related MBS and their collective actions triggered a pre-crisis crisis in Canada where billions of asset-backed commercial paper stopped rolling in August, offering those who were inclined to take notice a window …

National student loan debt reaches a bonkers $1.2 trillion

Kyle Craig wants to go to graduate school, but just being an undergraduate is already drowning him in debt. “I’ve got student loans just like everyone else walking around,” says Craig, a senior at Old Dominion University. “I expect my debt to be around $30,000 by the time I’m done here.” “Yes, I have student loans,” says Kyle Coghill, a …

Federal Report: The College Debt Bubble Is Collapsing Now: 33% Of All Student Loans Are Delinquent On Repayments

With all of that job creation being claimed by the Obama administration and disseminated by mainstream media outlets as signs of a sustained recovery you’d think most college graduates would have no trouble keeping up with their bills. But new data released by the Department of Education tell a different story. According to the report as many as 33% of American college …