US Secretary of State John Kerry may be starting to enjoy the brinkmanship, as he says it’s “unclear” whether the US and Iran would reach a political framework nuclear deal before the end of this month.

Loud applause may be heard in corridors ranging from Tel Aviv to Riyadh.

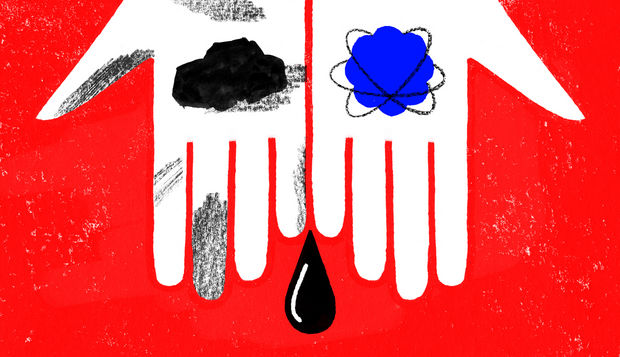

As negotiations resume in Lausanne, the fact is a potential nuclear agreement between Iran and the P5+1 (US, UK, France, BRICS members Russia and China, and Germany) is bound to open the possibility of more Iranian oil exports – thus leading oil prices to fall even further. As of early this week, Brent crude was trading at $54.26 a barrel.

Assuming the US and the EU nations that are part of P5+1 really agree to implement the suspension of UN sanctions by the summer (Russia and China already agree), not only will Iran be exporting more energy – that should take a few months – but also OPEC as a whole will be increasing its oversupply.

The EU badly wants to buy loads of Iranian energy – and invest in Iranian energy infrastructure. Beijing, a key yet discreet member of the P5+1, is also watching these developments very carefully.