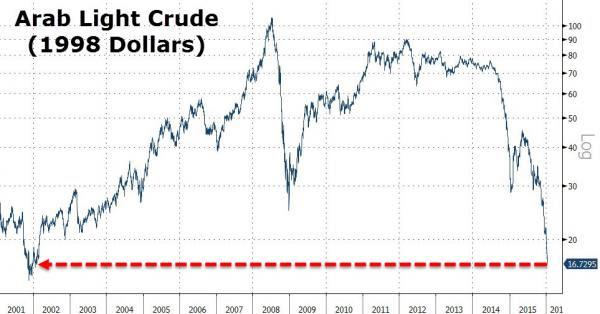

“You see a big destruction in the income of the oil and commodity producers,” exclaims on analyst but, as Bloomberg notes, while oil prices flashing across traders’ terminals are at the lowest in a decade, in real terms the collapse is considerably deeper. Adjusted for inflation, WTI is its lowest since 2002 and worse still Saudi Light Crude is trading at below $17 (in 1998 dollar terms) – the lowest since the 1980s…

Slumping prices are a critical signal that the boom in lending in China is “unwinding,” according to Adair Turner, chairman of the Institute for New Economic Thinking.

In fact, while sub-$30 per barrel oil sounds very scary, Saudi prices would be less than $17 a barrel when converted into dollar levels for 1998, the year oil sank to its lowest since the 1980s.