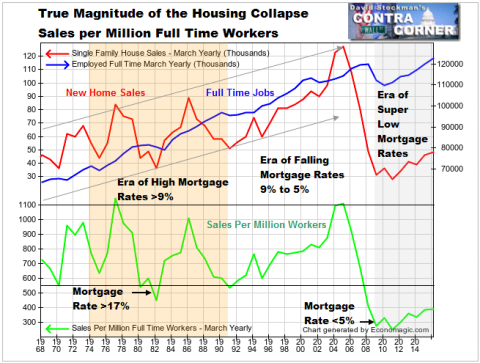

Comparing the growth in the number of full time jobs versus the growth in new home sales starkly illustrates both the horrible quality of the new jobs, and how badly ZIRP has served the US economy.

Growth in new home sales has always been dependent on growth in full time jobs. For 38 years until the housing bubble peaked in 2006, home sales and full time jobs always trended together, subject to normal cyclical swings. With the exception of 1981-83 when Paul Volcker pushed rates into the stratosphere, new home sales always fluctuated between 550 and 1,100 sales per million full time workers in the month of March.

But in the housing crash in 2007-09 sales fell to a low of 276 per million full time workers. Since then the number of full time jobs has recovered to greater than the peak reached in 2007. In spite of that, new home sales per million workers remain at depression levels.