The Bank of England, one of the oldest banks in the world, has joined the growing ranks of those warning of the

financial risk posed by a “carbon bubble,” which will occur

if urgently needed climate change regulations render coal, oil, and gas assets worthless.

“One live risk right now is of insurers investing in assets that could be left ‘stranded’ by policy changes which limit the use of fossil fuels,” Bank of England official Paul Fisher told (pdf) the Economist’s Insurance Summit 2015 in London on Tuesday. “As the world increasingly limits carbon emissions, and moves to alternative energy sources, investments in fossil fuels and related technologies—a growing financial market in recent decades—may take a huge hit.”

Reserves are by definition bodies of oil, gas or coal that can be drilled or mined for financial gain. Currently, regulators allow companies to book them as assets, and on the assumption that they are at zero risk of being stranded—left below ground, “value” unrealized—over the full life of their exploitation.

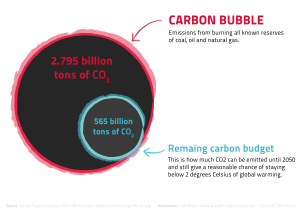

But several recent analyses have shown that

most existing reserves of fossil fuels cannot be burned

if global warming is to be limited to 2° Celsius, as the world’s nations have pledged. A study in January found that to avert climate disaster, the majority of fossil fuel deposits around the world—including 92 percent of U.S. coal, all Arctic oil and gas, and a majority of Canadian tar sands—must stay in the ground.

Despite such warnings, the Guardian notes, “companies spent $670bn (£436bn) in 2013 alone searching for more fossil fuels, investments that could be worthless if action on global warming slashes allowed emissions.”

The newspaper further cites former U.S. Treasury Secretary