Threatening bubbles on the horizon, debt and what does this mean for average Americans? Dr. Jack Rasmus is a professor of political economics at St.…

Mark Carney

- Home/

- Tag/

- Mark Carney/

It has been called “a bigger risk than Brexit”– the Italian banking crisis that could take down the eurozone. Handwringing officials say “there is no…

I was poised to write a piece on the linkage between present-day veneration of duplicitous political elites and the crisis of national identity when I…

Ever since the Corporate Form was "invented" - in its earliest avatar as the collective East India Companies - those who have ruled via corporation…

Let’s turn our attention to the global economy. Last week the Bank of England said it would buy 60 billion pounds of government debt in…

Shares and stocks are tumbling around the world, with investors worried that the next global crisis has already begun. There is considerable uncertainty and nervousness amongst economists…

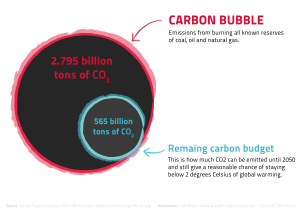

The Bank of England, one of the oldest banks in the world, has joined the growing ranks of those warning of the financial risk posed…