Global forecaster Gerald Celente provides a trend-tracking lesson by separating rhetoric, distortions and propaganda from fact in speeches made in response to the recent massacre…

Trends This Week

Gerald Celente is a pioneer trend strategist who founded the Trends Research Institute in 1980. Celente has built his reputation as a fearless teller of the truth, an accurate forecaster and an analyst whose expertise crosses many arenas, from economics to politics, from health to science, and more. Most important, Celente is a pure political atheist. Unencumbered by political dogma, rigid ideology or conventional wisdom, Celente -- whose motto is "think for yourself" -- observes and analyzes current events forming future trends by seeing them for what they are -- and not as what he'd like them to be. A best-selling author, Celente is the publisher of the quarterly Trends Journal and Trendsresearch.com. As with a doctor who gives his diagnosis after gathering the facts, whether or not you like the prognosis doesn’t alter the outcome, it’s simply what is. And while Celente holds a US passport, he considers himself a citizen of the world.

While Federal Reserve Chair Janet Yellen and fellow Fed members bombarded the business media with the refrain that America’s economy was strong, and to expect…

From Burberry to Hugo Boss, from Cartier to Tiffany, foot traffic is down, profits are slumping, stores are closing and markets are shrinking. Across the…

As Memorial Day approaches, global forecaster Gerald Celente reflects on the horrors of war and the cowards who lead us to war with lies and…

The Spring edition of the Trends Journal (available at Trendsresearch.com) was just released, featuring an in-depth analysis of how central banks have created a ticking…

Gerald Celente dissects President Obama's recent commencement address at Howard University. Beyoncé rules the world? That and other naive, ill-informed, out-of-touch, blatantly insulting Obama comments…

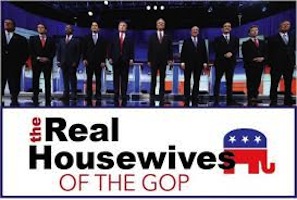

Gerald Celente recaps the latest episode of The Presidential Reality Show, forecasts what to expect and highlights the open window for progressive advancement that can…

Global master forecaster Gerald Celente analyzes the state of the presidential race as he reflects on the state of America's decline in the 21st Century…

Global forecaster Gerald Celente breaks down the reasons behind his Trends Research Institute's forecast that when presidential candidate Bernie Sanders bows out of the Democratic…

Direct Democracy, a longstanding guiding tenet of Gerald Celente and the Trends Research Institute, can work. Celente breaks down the failures of our leaders on…

The Trends Research Institute today affirmed our trend forecast, made one year ago, that Hillary Clinton will win the 2016 presidential race. And we now…

The Brussels terror attacks remind us, at least those of us able to think for ourselves, of the root causes of terrorism the media never…