It wouldn’t be a first, but it would certainly be a – bigger – shock. That is to say, the Bank of England hijacked the…

Bank of England

The battle between the ‘haves’ and ‘have-nots’ of global financial policy is escalating to the point where the ‘haves’ might start to sweat – a…

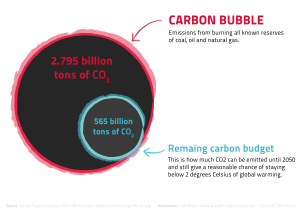

The Bank of England, one of the oldest banks in the world, has joined the growing ranks of those warning of the financial risk posed…