A red herring is something that takes attention away from a more important subject. Rig productivity and drilling efficiency distract from the truth that tight oil producers are losing money at low oil prices. Pad drilling allows many wells to be drilled from the same location by a single rig. Rig productivity reflects the increased volume of oil and gas …

Oil Market Uncertain As US Shale Boom “Goes Bust”

Oil market is uncertain as the US shale oil output is expected to fall for the first time in four years, and the coming months are likely to see a continuing price war between OPEC producers. Deutsche Bank, Goldman Sachs and HIS are now projecting that US oil production growth will now end. The global oil price rose slightly in …

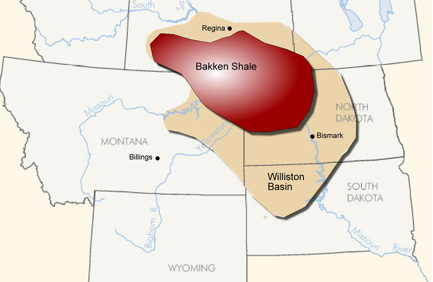

Bakken Shale Oil Well Output Drops To Lowest Since 2009 – Tyler Durden

In addition to the EIA’s amusing oil price forecast, which as noted previously leaves quite a bit to be desired considering it was a year ago that the EIA completely failed to anticipate the plunge in crude prices, which have collapsed far below its worst case estimate… … there is another more substantial problem with the EIA predicting a consistent increase in …