Download this episode (right click and save) The show leads with updates on latest evidence of stock buybacks in the US, which will exceed $800b…

Emerging markets

Dr. Rasmus delves deeper into this past week’s US and global stock crash. Is it another 2008? Or more like the dotcom tech bust of…

Dr. Rasmus reviews the major economic developments of the past year. Included are the major economic consequences of Trump’s first year in office: tax cuts,…

#1- Pollution in Latin Cities. How bad is it and what are governments and locals people doing about it, if anything. #2- More good reasons…

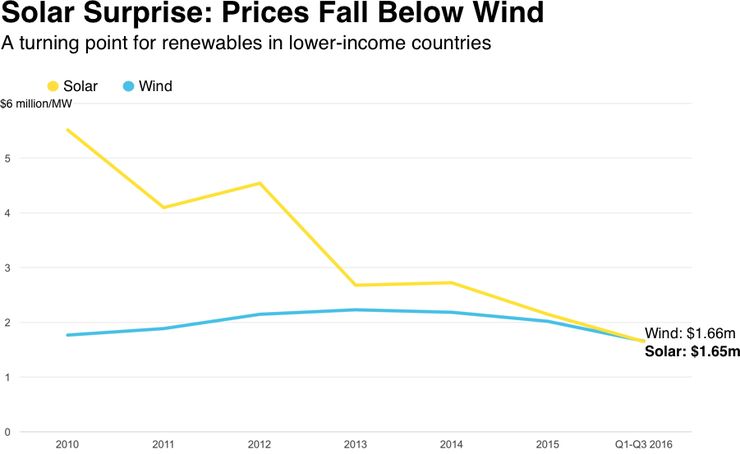

A transformation is happening in global energy markets that’s worth noting as 2016 comes to an end: Solar power, for the first time, is becoming the…

Dr. Rasmus reviews the US central bank’s decision this past week to raise rates, with three more hikes coming in 2017 (and more after in…

Jack focuses on the bubble growing in US stock markets, as money capital surges out of bonds and from Europe and emerging markets into US…

To stimulate the economy, create new jobs and generate new GDP requires an injection of new money. Borrowing from the bond markets or off-balance-sheet in…

When India ushered in neoliberal economic reforms during the early 1990s, the promise was job creation, inclusive growth and prosperity for all. But, some 25…

On October 12, the government of Mozambique quietly announced that it would close its Agriculture Promotion Centre (CEPAGRI), the agency created in 2006 to promote…

Populist movements - real populist movements, not the "pop" populism trumped in the U.S. - are building momentum across the globe. Gerald Celente breaks down…

NEW YORK – Fifteen years ago, I wrote a little book, entitled Globalization and its Discontents, describing growing opposition in the developing world to globalizing reforms. It…