A review of three just released reports that indicate the US and global economy is in much worst shape than the hype flowing from political…

Emerging markets

The Federal Reserve is flailing and global currency markets are in disarray. Notably, the Brazilian real dropped more than 10% in five sessions, before Thursday’s…

Imagine your doctor put you on a daily dose of oxycontin, phenobarbital and Quaaludes for six years straight. Then he suddenly cancelled your prescription. Do…

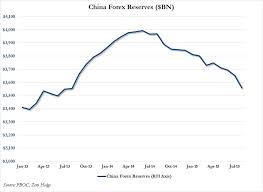

Shortly after the PBoC’s move to devalue the yuan, we noted with some alarm that it looked as though China may have drawn down its…

Housing markets are prone to the bandwagon effect, they continue rising when the fundamentals vanish, a year, maybe two years before. Stock market and commodity…

Capitalism is often touted as the most dynamic marketplace performer capable of lifting more boats faster than any other -- but why then do we…

BANGKOK -- China continues to grow at a not too shabby 7%. And yet, because of the yuan devaluation and the sharp drop in the…

Last weekend, we explained why it really all comes down to the death of the petrodollar. China’s transition to a new currency regime was supposed to represent…

On Tuesday evening, we asked what would happen if emerging markets joined China in dumping US Treasurys. For months we’ve documented the PBoC’s liquidation of its vast…

As the emerging market meltdown accelerates, plunging half of EM equity bourses into bear market territory and wreaking unspeakable havoc on currencies from LatAm to…

Everything seems to be going wrong in the global economy right now. Chinese growth is slowing, Hong Kong's Hang Seng is officially in a bear…

Jack Rasmus follows up the previous show on the global economy with an assessment of financial instability that appears to be growing globally as well.…