Central banks have cut Treasuries for three straight quarters Pullback may be a sign the bond market is at a tipping point Share on FacebookShare…

European Central Bank

Populist movements - real populist movements, not the "pop" populism trumped in the U.S. - are building momentum across the globe. Gerald Celente breaks down…

Jack takes a detailed look at the strategic and tactical errors of the Syriza party and Greek government in 2015 that led to its eventual…

This week marks the first anniversary of the 2015 Greek debt crisis, the third in that country’s recent history since 2010. Last Aug. 20-21, 2015,…

Dr. Rasmus discusses the first of a two part series on the nature of Greek debt crises, and how they are the consequence of Euro…

Beneath the marionette theater of American electoral and parliamentary democracy, policy is made by a “deep state” oligarchy of corporate and financial elites. The political…

Jack Rasmus explains why all economic indicators for the US economy are ‘flashing red’ except for consumer spending, driven mostly by surging household debt again…

This week began with a debate in Greek Parliament called by the Official Opposition (the troika’s main, but not only, domestic cheerleaders) for the purposes of,…

Jack reviews today’s just released jobs numbers confirming his prior prediction jobs growth would slow in wake of US GDP slowdown last quarter. Plus an…

Last week a research wing of the International Monetary Fund came out with a report admitting that neoliberalism has been a failure. The report, entitled, “Neoliberalism: Oversold?”…

China is blowing an even bigger industrial-growth bubble, central banks are attempting to prevent a global shock, and, meanwhile, all eyes are on the US…

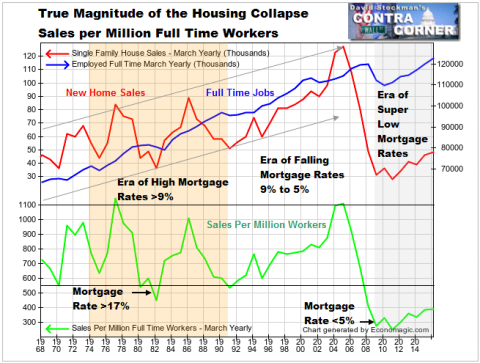

Comparing the growth in the number of full time jobs versus the growth in new home sales starkly illustrates both the horrible quality of the new jobs,…