On Thursday, Amazon, the online retail giant, announced that, contrary to analysts’ predictions and after months of financial losses, it had turned a profit in…

Gross domestic product

China’s two main stock markets, the Shanghai and the Shenzhen Exchanges, plunged more than 30% in recent weeks from their previous record highs of June…

Meeting late into Sunday night, euro zone heads of government issued new ultimatums to Greece that would effectively strip the country of its sovereignty and…

Worse than any disease or even leprosy, anyone spouting Austrian economics or even “common sense” (almost extinct today) has been shoved into the outcast corner…

NATO defense ministers meeting in Brussels Wednesday and Thursday agreed to the enlargement of the organization’s Response Force to 40,000 troops from the current level…

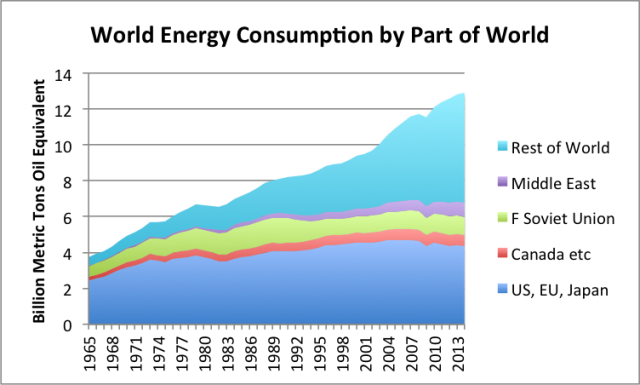

Some people talk about peak energy (or oil) supply. They expect high prices and more demand than supply. Other people talk about energy demand hitting a…

“Since its founding, the United States has consistently pursued a grand strategy focused on acquiring and maintaining preeminent power over various rivals, first on the…

The Obama administration this week will continue to wrestle with reluctant congressional Democrats seeking a compromise to advance the president's hoped-for legacy of expanding trading…

Two recent reports suggest that Israel could face catastrophic consequences if it fails to end the mistreatment of Palestinians under its rule, whether in the…

Economic growth has bee at zero percent or lower for two or three years in a row in most of the western world. Cooked government…

On Monday March 25, many African Government offices, businesses and banks grind to a halt in order to commemorate Africa Day. In schools up and…

Subsidies for fossil fuels that cause climate change have soared since 2013, a new study from the International Monetary Fund has revealed. Oil, gas and…