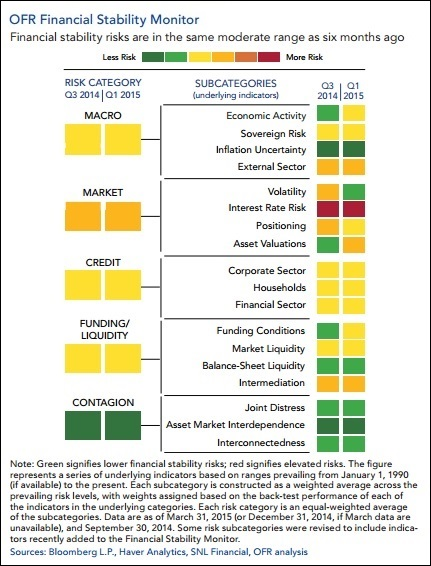

Remember when the Department of Homeland Security was issuing those color-coded terrorist alerts? Well, they don’t do that anymore. They’re back to using plain ole black-and-white words to describe threats. Apparently, however, the U.S. Treasury’s Office of Financial Research (OFR) thought it was such a cool idea that they’ve started color-coding threats to our financial security from the denizens on Wall …

VACCINE ECONOMICS – GREED, POLITICS, AND DISEASE PROFIT by Joel Edwards

Imagine if you had a product to sell that didn’t require advertising or marketing, but the majority of people thought they had to have it. Better still, millions of children and adults are forced to obtain your product in order to keep their jobs or go to school. The government is one of your guaranteed buyers. Your product doesn’t need …

Why Jamie Dimon Is One of the Biggest Economic Polluters in America By Lynn Stuart Parramore

Ed Kane, a professor of finance at Boston College and grantee at the Institute for New Economic Thinking [3], studies the dangerous risk-taking of giant banks. He sees the cultures of Wall Street and regulators coming together to turn taxpayers into victims of theft and great harm. Like extreme drunk drivers before MADD or smokers on airplanes prior to the 1980s ban, …

Failures of Central Banks, Interest Rates, Derivatives and Crisis in the Credit Market By Bill Holter

Global markets are changing drastically and showing volatilities like we saw back in late 2008. I am not talking about stock markets, it is the debt and currency markets that are schizophrenic. Oddly, even after all of the various Western “QE’s”, liquidity suddenly looks like it is drying up. A great article as to why even the depth in the …

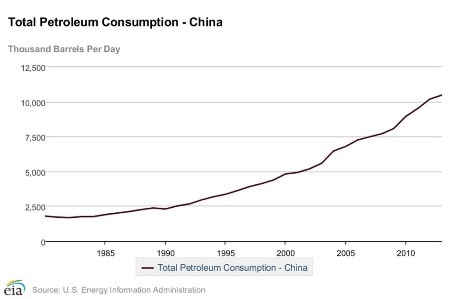

Oil Markets Could Be In For A Shock From China Soon By Nick Cunningham

Oil analysts and commodity traders watch the price of crude swing down and up, and are trying to figure out when and to what extent the OPEC “price war” will force supply reductions from US shale. Any insight into this development can clarify the trajectory of oil prices. But, of course, oil market dynamics are complex and fluid. US shale …

Why The Powers That Be Are Pushing A Cashless Society

Martin Armstrong summarizes the headway being made to ban cash, and argues that the goal of those pushing a cashless society is to prevent bank runs … and increase their control: The central banks are … planning drastic restrictions on cash itself. They see moving to electronic money will first eliminate the underground economy, but secondly, they believe it will even prevent …

Agribusiness and the The Four Horsemen Of The Apocalypse. The Globalized System of War, Poverty and Food Insecurity – Colin Todhunter

US citizens constitute 5 percent of the world’s population but consume 24 percent of global energy. On average, one person in the US consumes as much energy as two Japanese, six Mexicans, 13 Chinese, 31 Indians, 128 Bangladeshis, 307 Tanzanians and 370 Ethiopians. The US is able to consume at such a level because the dollar serves as the world reserve currency. …

The “War on Cash” in 10 Spine-Chilling Quotes – Don Quijone

The war on cash is escalating. As Mises’ Jo Salerno reports, the latest combatant to join the fray is JP Morgan Chase, the largest bank in the U.S., which recently enacted a policy restricting the use of cash in selected markets; bans cash payments for credit cards, mortgages, and auto loans; and disallows the storage of “any cash or coins” …

Largest Bank In America Joins War On Cash – Tyler Durden

The war on cash is escalating. Just a week ago, the infamous Willem Buiter, along with Ken Rogoff, voiced their support for a restriction (or ban altogether) on the use of cash (something that was already been implemented in Louisiana in 2011 for used goods). Today, as Mises’ Jo Salerno reports, the war has acquired a powerful new ally in Chase, the largest …

US economic decline overshadows IMF-World Bank meeting – Nick Beams

The annual spring meetings of the International Monetary Fund and World Bank held in Washington over the weekend comprised the treasurers and central bankers, together with financial experts and analysts, from all the major capitalist economies. However not a single proposal was advanced from this high-level meeting to alleviate, let alone resolve, the mounting problems besetting global capitalism. The reason …