Economic forecasters exist to make astrologers look good, but I’ll hazard a guess. I expect the U.S. economy to sputter in 2016. That’s because the economy faces a deep structural problem: not enough demand for all the goods and services it’s capable of producing. American consumers account for almost 70 percent of economic activity, but they won’t have enough purchasing …

James Howard Kunstler – Say Goodbye to Normal

The tremors rattling markets are not exactly what they seem to be. A meme prevails that these movements represent a kind of financial peristalsis — regular wavelike workings of eternal progress toward an epic more of everything, especially profits! You can forget the supposedly “normal” cycles of the techno-industrial arrangement, which means, in particular, the business cycle of the standard economics textbooks. …

Central Bank of Central Banks Warns That World is Unprepared to Fight Global Crash By Mac Slavo

According to the Bank for International Settlements (BIS), the shadowy “central bank of central banks,” the world as it stands is incapable of combating another global financial crash – a crash that there is every reason to think is coming. That’s because the economy remains in the hands of the Federal Reserve and other central banks. The financial wizards in THIS …

VACCINE ECONOMICS – GREED, POLITICS, AND DISEASE PROFIT by Joel Edwards

Imagine if you had a product to sell that didn’t require advertising or marketing, but the majority of people thought they had to have it. Better still, millions of children and adults are forced to obtain your product in order to keep their jobs or go to school. The government is one of your guaranteed buyers. Your product doesn’t need …

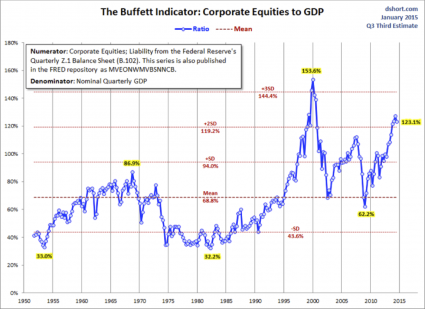

If Anyone Doubts That We Are in a Stock Market Bubble, Show Them This Article

The higher financial markets rise, the harder they fall. By any objective measurement, the stock market is currently well into bubble territory. Anyone should be able to see this – all you have to do is look at the charts. Sadly, most of us never seem to learn from history. Most of us want to believe that somehow “things are …

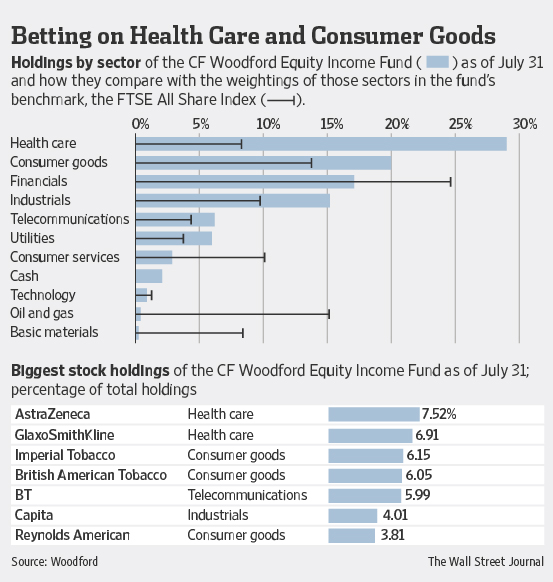

Are Equities Overvalued?

Since the global economic crisis, sharp divergences in economic performance have contributed to considerable stock-market volatility. Now, equity prices are reaching relatively high levels by conventional measures – and investors are starting to get nervous. The question is whether stock valuations are excessive relative to future earnings potential. The answer depends on two key variables: the discount rate and future …