Why have economies polarized so sharply since the 1980s, and especially since the 2008 crisis? How did we get so indebted without real wage and living standards rising, while cities, states, and entire nations are falling into default? Only when we answer these questions can we formulate policies to extract ourselves from the current debt crises. There is widespread sentiment …

Ken Roseboro – Organic Food, Not Just for Hippies Anymore: How the U.S. Is Dealing With Growing Demand

An old adage says that solving a big problem requires attacking it from all sides. That is what organic industry players—large and small—are doing to overcome organic crop supply shortages in the U.S. Organic supporters have launched a range of initiatives to increase organic farming acreage—from big company initiatives and smaller company collaborations to a new organic transition certification and long-term contracts …

JACK RASMUS – The Next Global Financial Fault Line

Global Equity Markets In the past year the stock markets in China erupted, contracting by nearly 50% in just three months, after having risen in the preceding year by 130%–truly a ‘bubble event’. That collapse, commencing in June 2015, continues despite efforts to stabilize it. Chinese bankers then injected directly $400 billion to stem the decline. Including other government and …

Prof. Ismael Hossein-Zadeh – Who Owns the Federal Reserve Bank—and Why is It Shrouded in Myths and Mysteries?

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. (Henry Ford) Give me control of a Nation’s money supply, and I care not who makes its laws. (M. A. Rothschild) The Federal Reserve Bank (or simply the Fed), …

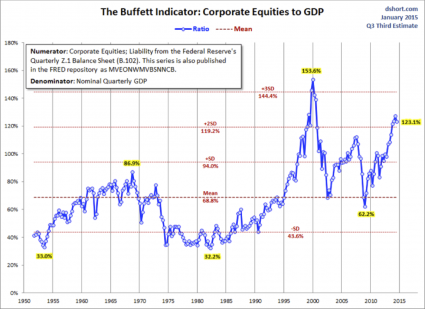

If Anyone Doubts That We Are in a Stock Market Bubble, Show Them This Article

The higher financial markets rise, the harder they fall. By any objective measurement, the stock market is currently well into bubble territory. Anyone should be able to see this – all you have to do is look at the charts. Sadly, most of us never seem to learn from history. Most of us want to believe that somehow “things are …