Jack Rasmus explains why all economic indicators for the US economy are ‘flashing red’ except for consumer spending, driven mostly by surging household debt again in credit cards, mortgages, auto loans and student loans. Meanwhile, 7 years of continued low interest rates created by the Federal Reserve (and other central banks) are creating a crisis in pensions, insurance, and sectors …

Alex Henderson – 10 Economic Woes Generation X Faces

You hear a lot about millennials being in a tight spot financially, but less about the generation sandwiched between them and the baby boomers: Generation X. The oldest Gen-Xers were born in the mid-1960s and are now in their early 50s; many other Xers are well into their 40s, and they’ve suffered the brunt of several economic downturns. Gen-X, which …

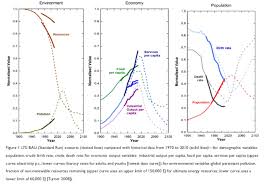

Pete Dolack – Could an Economic Collapse be in Our Near Future?

Climate scientists and others have in the past few years issued a steady stream of analyses showing that without immediate remedial actions, a disastrous future is headed our way. But is it a four-decade-old study that will prove prescient? That study, issued in the 1972 book The Limits to Growth, forecast that industrial output would decline early in the 21st century, …

What the Heck is Going on in the Stock Market?

Even Moody’s which is always late to the party with its warnings – but when it does warn, it’s a good idea to pay attention – finally warned: “Don’t fall into the trap of believing all is well outside of oil & gas.” What happened on Friday was the culmination of another dreary week in the stock markets, with the Dow …

Trends This Week – The Economic Meltdown: It’s Global. Period. – 01.27.16

Want to know the truth behind those wild swings in global markets? Listen to this program with global master forecaster Gerald Celente. The facts prove it. With just three trading days left in January, in the history of the Dow Jones, there has never been a new year that has rung in on such a down note. And the wild market ride has spread far beyond Wall Street. Just one week ago, the global equity rout sent the MSCI All-Country World Index into bear territory. From China to Japan, from the UK to France, stocks were down more than 20 percent from 2015 highs. Among the higher-risk emerging markets, stocks dove to their lowest levels since May 2009. Overall, some $15 trillion in global equity values has been lost since the year began. Beyond diving equities, commodity prices are down to 1991 levels, according to the Bloomberg Commodity Index. Thus, among many resource-rich nations whose exports have sharply fallen along with the prices of the commodities they sell, their currencies’ value also has dramatically declined. There’s a rough ride ahead. Prepare. Prevail. Prosper.

Mike Whitney – The Fed’s Role in the Stock Market Slide

When the Dow Jones Industrial Average (DJIA) and S&P peaked in May 2015, investors were still confident that the Fed “had their back” and that any steep or prolonged downturn in stocks would be met with additional liquidity and a firm commitment to maintain zero rates as long as necessary. But now that the Fed has started its long-awaited rate-hike …

Nick Beams – World Socialist Web Site

After an initial rise following the decision by the US Federal Reserve to lift interest rates by 0.25 percentage points on Wednesday, stock markets around the world have experienced significant declines over the past two days. The biggest falls were in the United States, where the Dow was down by 368 points at the close of trade on Friday, a …

Michael Snyder – December 14th To 18th: A Week Of Reckoning For Global Stocks If The Fed Hikes Interest Rates?

Are we about to witness widespread panic in the global financial marketplace? This week is shaping up to be an absolutely critical week for global stocks. Coming into December, more than half of the 93 largest stock market indexes in the world were down more than 10 percent year to date, and last week stocks really started to slide all over …

Economic Update – Big vs Small Business – 11.22.15

Updates on Japan’s Recession, half of New York City economically in trouble, ACA deductibles undermine affordability, Million student March, another crooked capitalist. Response to listeners on private vs public enterprises. Major topics: small vs big business and big ideas not being discussed in campaigns.

DAVID RANDALL – Investors brace for stocks to fall again ahead of earnings

The global market volatility of the past month that sent U.S. stocks to their worst quarter in four years shows no signs of letting up just because the calendar turned to October. Investors say they are bracing for another leg down in the S&P 500 stock index despite its positive showing last week by increasing cash and other defensive positions …