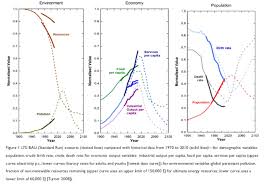

Climate scientists and others have in the past few years issued a steady stream of analyses showing that without immediate remedial actions, a disastrous future is headed our way. But is it a four-decade-old study that will prove prescient? That study, issued in the 1972 book The Limits to Growth, forecast that industrial output would decline early in the 21st century, …

CHRIS MARTENSON – The Return of Crisis: Everywhere Banks are in Deep Trouble

Financial markets the world over are increasingly chaotic; either retreating or plunging. Our view remains that there’s a gigantic market crash in the coming future — one that has possibly started now. Our reason for expecting a market crash is simple: Bubbles always burst. Bubbles arise when asset prices inflate above what underlying incomes can sustain. Centuries ago, the Dutch woke …

Alternative Visions – ‘Three Official Reports Point to Global Economic Trouble’ – 10.02.15

A review of three just released reports that indicate the US and global economy is in much worst shape than the hype flowing from political and business media sources. Today’s US jobs report showed a sharp reduction in the rate of private sector job growth in the US economy for the past three months, as labor force and wage growth continue to stagnate as well. Jack explains why the official data is even worse than reported. A second report by the World Trade Organization indicates global trade is retreating fast, growing much less than global GDP which is itself slowing fast. According to estimates, global trade may have even contracted in the first half of 2015. Jack explains how a global recession in trade and industrial production (manufacturing, mining, utility output) may have already begun, with global services eventually to follow. Conditions in Europe, Japan, China, and the ‘perfect storm’ accelerating in Emerging Markets from latin America to Asia to Africa are reviewed. Next week’s IMF report on the growing crisis in the global economy, centered on emerging markets and China, is previewed. In the context of these developments, Jack explains how his new, forthcoming book, ‘Systemic Fragility in the Global Economy’, by Clarity Press, due out in November provides a theoretical and empirical explanation of the conditions and where the economy is headed, and how the book is different fundamentally from analyses provided by both mainstream economists or Marxist economists.’

Alternative Visions – ‘US Fed Reverses Course on Rate Hikes? + ‘How Big Pharma is Killing Us’ – 09.25.15

Jack reviews briefly the apparent flip-flop by Janet Yellen, chair of the US central bank, in her talk on September 24, as she shifted course from last week’s Fed meeting, and signaled that a US interest rate hike will almost certainly come in December. How the Fed is now caught between its emerging, contradictory role as central bank for the US as well as for the global economy. Jack challenges Yellen’s view that US prices, now at 0.5%, will eventually rise as oil prices reverse and increase again and as the labor market in the US improves—and explains why this is not likely to happen soon. In the second half of the show, big Pharmaceutical companies are the topic. Jack explains how Wall St. and shadow bankers increasingly run Pharma and have turned it into a speculative investing center where drug price manipulation and gouging is increasingly the norm causing astronomically price hikes for life-saving drugs, with the result of killing of countless more Americans denied unaffordable drugs. How Wall St. has turned the industry, from what should be a public good, into a $500 billion speculative profits center with 20% annual rates of return, into a prime source of mergers and acquisitions profits for banks, and into a major tax avoidance (thru global tax ‘inversions’) industry that gets $100 billion in government R&D subsidies. Jack reviews in detail the latest scandal to hit the press this past week, with Turing Corp.’s 5000% increase for a pill to treat toxoplasmosis that prevents infections in pregnancies, cancer, and AIDs patients. Similar price manipulations delivering ‘rentier’ profits by Rodelis Corp., Valeant Corp., Alexion and Gilead Corps are reviewed. How the disease of finance capital is spreading throughout the US economy as bankers and corporate America continue to ‘kill’ Americans in the name of excess profits.

Nomi Prins – Mexico, Federal Reserve Policy and Danger Ahead for Emerging Markets

On August 27th, I had the opportunity to address the Aspen Institute, UNIFIMEX and PWC in Mexico City during a Q&A with Patricia Armendariz. Subsequenty, on August 28th, I gave the opening talk at the annual IMEF conference. The main issues of concern to local Mexican banks, as well as to Mexico’s central bank, are: 1) How the Federal Reserve’s …

Charles Hugh Smith – Is the Stock Market Now “Too Big to Fail”?

Correspondent Bart D. recently speculated that the U.S. stock market was now “too big to fail,” that is, that it was too integral to the global financial system and economy to be allowed to fail, i.e. decline 40+% as in previous bubble bursts. The U.S. stock market is integral to the global financial system in two ways.Now that investment banks, …

Dean Baker – The China Syndrome: Bubble Trouble

The financial markets have been through some wild and crazy times over the last two weeks, although it appears that they have finally stabilized. The net effect of all the gyrations is that a serious bubble in China’s market seems to have been at least partially deflated. After hugely over-reacting to this correction, most other markets have largely recovered. Prices …

Justin Fox – Maybe This Global Slowdown Is Different

The global economy is slowing down. A couple of the big emerging-market economies that drove much of the growth during the past 15 years have hit a wall, and the question of the moment is whether the biggest of them, China, is in real trouble too. Commodity prices are tanking. Trade volumes are down. The Baltic Dry Index of shipping costs, which …

Michael Snyder – This 2 Day Stock Market Crash Was Larger Than Any 1 Day Stock Market Crash In U.S. History

We witnessed something truly historic happen on Friday. The Dow Jones Industrial Average plummeted 530 points, and that followed a 358 point crashon Thursday. When you add those two days together, the total two day stock market crash that we just witnessed comes to a grand total of 888 points, which is larger than any one day stock market crash in U.S. history. …

Alternative Visions – Is the Global Economy Heading for Another Financial Crisis? – 08.08.15

Jack Rasmus follows up the previous show on the global economy with an assessment of financial instability that appears to be growing globally as well. Jack briefly discusses how excess debt and income decline and stagnation basically cause financial instability, and explains how the new 200,000 or so global finance capital elite continue to create financial asset bubbles worldwide and how those bubbles appear to be converging. Financial bubbles that appear most unstable include China’s stock markets (Shanghai and Schenzhen), but also global oil and commodity futures, emerging market equity and bond markets, US and global bond ETFs sold by mutual funds, the US and Euro corporate junk bond markets, tech stocks, Eurozone banks, and currency exchange markets that are becoming much more volatile. Also noted are potential serious secondary effects of a lack of liquidity in bond markets in general and effects on US repo markets in turn. The show concludes with a in-depth look at causes behind the current China stock market collapse which, Jack argues, has yet to run its full course and could destabilize financial markets worldwide in the near future. The role of China government policies in causing a runup of 120% in China stocks in just one year is explained, as well as government measures introduced since June 12 of this year to stop the stock slide.