Global Equity Markets In the past year the stock markets in China erupted, contracting by nearly 50% in just three months, after having risen in the preceding year by 130%–truly a ‘bubble event’. That collapse, commencing in June 2015, continues despite efforts to stabilize it. Chinese bankers then injected directly $400 billion to stem the decline. Including other government and …

Alternative Visions – Global Currency Wars & Devaluations Poised to Accelerate in 2016 – 12.04.15

Jack Rasmus looks at yesterday’s decision by the European Central Bank to make token changes to its QE policies, Japan’s central bank rumors of more QE, and the US Federal Reserve’s imminent raising of interest rates later this month. Why the ECB did not go ‘all in’ to expand its QE? Reasons: waiting on US Fed to move first, weaken German opposition to a later big QE boost, and ‘holding its powder’ for possible worse deflation and EU economy in 2016. Japan waiting on both US and Europe. Meanwhile, US Fed caves in to political moves by Congress attacking it. Conclusion: more QE in 2016, more currency devaluation, more pain in emerging markets and slowing of US exports and manufacturing, and China need to devaluate further next year. Recent economic news of importance is reviewed: oil price glut to continue despite Vienna OPEC meeting; China’s Yuan approved by IMF as global currency, and Brazil’s economy now tipping over into depression. Jack concludes with latest review of US economic performance: manufacturing and exports contracting, business inventories excess and spending, US residential housing growth now spent and flattening, poor Xmas retail sales emerging, auto sales based on debt reaching peak, savings from gasoline price declines diverting to rents, education and health care price increases, and now service sector growth slowing rapidly. Next Week show theme: ‘Systemic Fragility in the Global Economy, Part 1’, as Jack reviews conclusions of his just published book.

Vojko Volk – The Failure — and Future — of Democracy In Europe

There’s at least one reason we should be grateful to the Greek people for exposing the European Union’s democratic dysfunction this summer: Their recent referendum showed that majority rule is impossible in a multinational union. Creating the illusion of democratic decisions within the EU, even when there is no clear will among the member states, has returned like a boomerang …

The Gary Null Show – 07.27.15

Today, the latest in health and healing, including poor sleep and Alzheimer’s, healing benefits of turmeric, and breastfeeding may lower the risk of leukemia in children. Also, evidence on ineffectiveness of chemotherapy. Finland is the poster child for why the euro doesn’t work. Plus, information on the placebo effect. And much more!

Governments Worldwide Will Crash the First Week of October … According to 2 Financial Forecasters by WashingtonsBlog

Two well-known financial forecasters claim that virtually all governments worldwide will be hit with a gigantic economic crisis in the first week of October 2015. Martin Armstrong is a controversial market analyst who correctly predicted the 1987 crash, the top of the Japanese market, and many other market events … more or less to the day. Many market timers think …

So-called ‘free trade’ agreements should be strongly opposed – Bill Mitchell

My header this week is in solidarity for the Greek people. I hope they vote no and then realise that leaving the dysfunctional Eurozone will promise them growth and a return to some prosperity. They can become the banner nation for other crippled Eurozone nations – a guiding light out of the madness that the neo-liberal elites have created. While …

Greek Debt Negotiations at 11th Hour – The Troika’s ‘Carrot and Stick’ By: Jack Rasmus

The weekend of June 27-28 marks the likely last comprehensive negotiating session between the Troika and the Greek government before the current extension of the debt agreement between Greece and the Troika formally expires on June 30, 2015. As final negotiations come down to the wire, the class nature of the bargaining positions of the two parties is becoming …

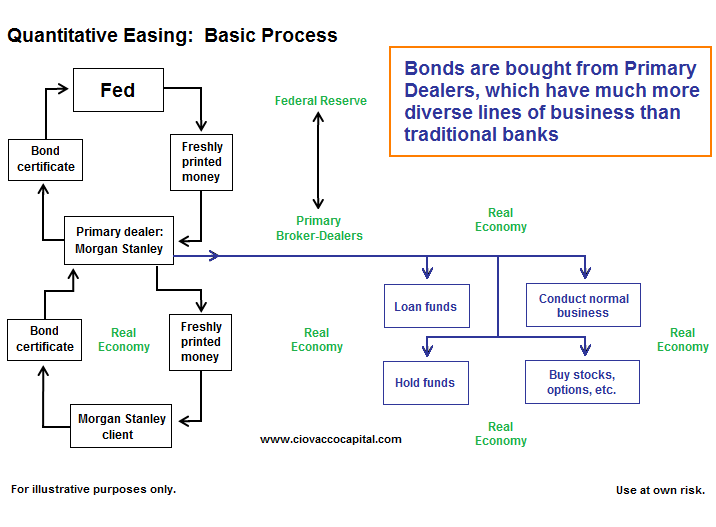

The voodoo economics of Europe’s quantitative easing policy

In Europe, failure is no longer an option. If banks are in danger of collapse, in come the bailout loans. If countries have trouble financing themselves, the European Central Bank will buy their sovereign bonds. When inflation falls and growth stalls, there is a cure for that too – quantitative easing. QE, as it’s called, was officially announced in January …