When we discuss the impending crisis of our civilisation, we mainly look at the resources our economy need in a growing quantity. And we explain why the Diminishing Returns of resource exploitation pose a growing burden on the possibility of a further growing of the global economy. It is a very interesting topic, indeed, but here I suggest to turn …

LOA Today – 02.11.16

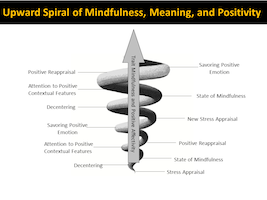

Those darn spirals! When they’re positive spirals, they feel great. It feels like you can’t do anything wrong. But the negative spirals are the worst. One misstep seems to lead to another. In today’s show, we talk about getting out of negative spirals and into positive spirals.

Trends This Week – Keep your eye on the banking crisis – 02.10.16

Don’t the buy the media line that the volatility in global markets is all about oil. It’s not. Not even close. The fast-moving meltdown in those markets resulting in global recession is the eventual price world economies will pay for chronically injecting cheap money into the market for the last decade, artificially pumping up the economy and masking the spreading cancer below the surface. Now, six weeks into the new year, the mad swings in the markets will more and more center on the banks. Watch the banking crisis as it unfolds. Global stock indexes have plunged into bear territory, currencies are crashing – and as commodity prices tumble, resource-rich nations going broke are begging the World Bank and International Monetary Fund to bail them out. Neither “The Panic” nor the Global Recession, one of our Top Trends for 2016, will spare any country, large or small. We are looking at a Global Recession turning into a Global Depression. And when all measures fail to revive the economy – “they take you to war.”

Alternative Visions – Global Economy Continues to Unravel As US GDP Slows to 0.7% – 01.29.16

More indicators show growing instability in the global economy, as US economy now appears to be slowing rapidly as well. Jack disassembles US 4th quarter 2015 initial GDP numbers, showing durable goods falling at the fastest rate since 1992, as business spending and inventories and exports continue to pose a problem into 2016. Jack predicts yet another ‘economic relapse’—the fifth in as many years—on the horizon for the US for 2016. Elsewhere, global instability continues to rise: Japan announces surprise negative interest rates, pre-empting Europe’s soon announcement of another QE expansion—which will intensify global currency wars further. China capital flight reaches $1 trillion, and Jack predicts inevitable Yuan devaluation coming. Italian banks in big trouble with more than $350 billion in non-performing bank loans (Europe more than $1.5 trillion). Why economists are confused about the correlation of stock price and oil price collapse occurring now. Jack’s view of unreliability of China stats confirmed by sacking of its statistics director this week, Wan Baoan. Japan stats with resignation of Akira Amani as well. Jack reviews billionaire speculator, George Soros’, predictions at interview at Davos last week, confirming China ‘hard landing’ underway and threat of spreading deflation, which Jack predicted in his book, ‘Systemic Fragility in the Global Economy’.

Economic Update – Economic Lessons from 2015 – 12.20.15

Updates on FED’s interest rate hike, Peter Drucker on “like a business,” gun business, and oil economics. Response to question on whether it is China that is slowing the world economy. Major discussion of Greek and Spanish austerity politics and how major oil, banking and auto corporations proved why we can and must do better than capitalism

Nick Beams – A new tipping point in the global economic crisis

The announcement by the global mining giant Anglo American that it will sack 85,000 workers world-wide, put 60 percent of its assets up for sale, and reduce its mining sites from 55 to just 20 signifies that the crisis of the world capitalist economy is heading toward a new tipping point. The world economy is threatened by a plunge into …

The Emerging Market Growth Model Is “Broken”; RIP EM

It’s that time of year again, when every sellside macro strategist peers into his or her crystal ball in a completely futile effort to predict the direction the global economy economy will take in the year ahead. As everyone knows, the only thing more difficult than forecasting the weather is forecasting economic outcomes (economics is, after all, merely a pseudoscience …

Laura Colby – How Do You Boost GDP by $28 Trillion? Gender Equality Would Do It, McKinsey Says

Denying women full participation in the global economy is costly.McKinsey & Co. has now calculated by just how much. Full gender equality would add 26 percent, or $28 trillion, to globalgross domestic product in 2025, according to a new report by the consulting firm’s research and economics arm. While capturing that potential may not be realistic in the short term, boosting women’s …

Citi Just Made “Global Recession In 2016” Its Base Case Scenario

Over the weekend, we reported that in a dramatic turn of events, the research division of Japan’s second biggest brokerage house, Daiwa, did what nobody else has done before and released a report in which it made a global financial “meltdown”, one resulting from nothing short of a Chinese economic cataclysm its base case scenario, its base case. It added …

Nick Beams – The G20 summit: A spectacle of political bankruptcy

The meeting of G20 finance ministers and central bankers held in Ankara, Turkey over the weekend underscored the inability of the major capitalist powers to initiate any measures to halt the recessionary forces overtaking the world economy. Rather than a proposal for concerted action, the official communique was a public relations exercise aimed at masking the acuteness of the crisis …